Talking Points

- The technical outlook for the DAX 30 is little changed for almost a week.

- Several DAX critical reports are on deck today and may influence positioning in the index over the next few days. These include the Markit PMIs, German IFO and ZEW index.

- In the afternoon, U.S. Markit Mfg. PMI is on tap.

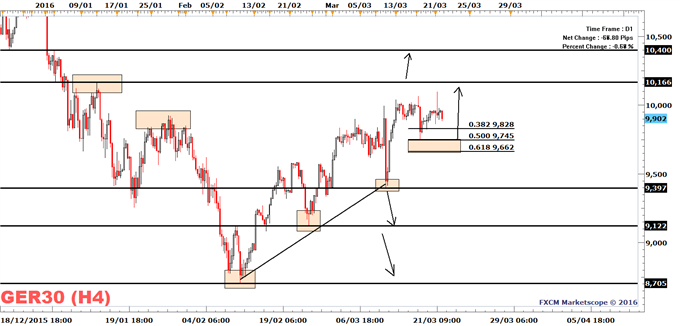

The DAX 30 has an underlying bullish trend since mid-February and as long as it trades above the March 10 low of 9397 it may drift higher. The January 13 high of 10,166 is resistance and this is followed by the January 5 high of 10,395. These two levels are potential targets for the bullish trend.

As the trend is bullish, a short-term decline, like to the 9745 to 9662 range may be of temporary nature, as traders start to see this as an opportunity to add to their bullish exposure.

These two levels are derived using the Fibonacci retracement tool, with the March 10 low of 9397 and the March 21 high of 10,100both used as reference points.

On the German DAX extending below the March 10 low of 9397, the bullish trend may have ended and price might not find support until the next low, the February 24 low of 9122, lends its support.

German Economic Data

Several DAX critical reports are on deck today and may influence positioning in the index over the next few days.

At 08:30 GMT the German March Markit flash PMI is expected to decline to 50.8 vs 50.5, while services PMI is seen at 55.0 vs 55.3, (Bloomberg news survey).

At 09:00 GMT the German March IFO index figures are released and the business climate is seen as being at 106 vs 105.7, with Current Conditions at 112.7 vs 112.9, and Expectations at 99.5 vs 98.8.9.

The German data is concluded at 10:00 GMT with the March ZEW sentiment index. The economic sentiment is expected to print 53 from 52.3, while the expectations index is expected to be at 5.4 from 1.

Download the DailyFX Analysts' 1Q forecasts for the Dollar, Euro, Pound, Equities and Gold

DAX 30 | FXCM: GER30

Created with Marketscope/Trading Station II; prepared by Alejandro Zambrano

--- Written by Alejandro Zambrano, Market Analyst for DailyFX.com

Contact and follow Alejandro on Twitter: @AlexFX00

Struggling with Trading? Join a London Seminar