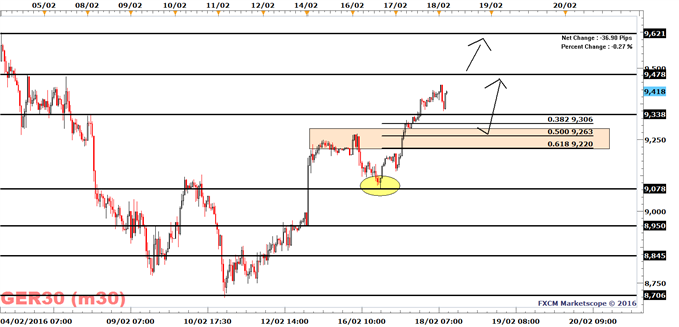

The DAX 30 remains buoyant, and a break to the February 4 high at 9478 may trigger further entry orders lifting the DAX 30 to its February 3 high of 9621.

The last important low for the market and bullish trend is the February 16 low at 9078. I expect traders to see a pullback to the 9305 to 9220 range as an opportunity to add to their bullish exposure. While a break to the February 16 low at 9078 will open the door for a test to the current monthly low at 8706.

Who Is Buying At These Levels?

For the U.S. stock markets we have seen a clear outperformance over the last week in the shares of heavily shorted firms. It’s fair to expect the same for the DAX 30, which means that a break to the February 4 high at 9478 may indeed generate a further run to 9621 (as bearish traders are forced to close out their bets).

The trigger for this rally has been better than expected data from the U.S.

Last week U.S. Retail sales beat expectations. Yesterday, U.S. Industrial production beat estimates by growing 0.9% MoM versus 0.4% expected, and from negative 0.4% in December. The year-on-year growth was -0.7%, which is not good but less severe than the 1.89% contraction in December.

This brings my monthly U.S. GDP estimator to suggest U.S GDP rose by 1.32% YoY in January from 0.92% in December. While these numbers are not great, they have taken the gloomy traders by surprise.

See the DailyFX Analysts' 1Q forecasts for the Dollar, Euro, Pound, Equities and Gold

DAX 30 | FXCM: GER30

Created with Marketscope/Trading Station II; prepared by Alejandro Zambrano

--- Written by Alejandro Zambrano, Market Analyst for DailyFX.com

Contact and follow Alejandro on Twitter: @AlexFX00

Struggling with Trading? Join a London Seminar