British Pound Outlook:

- The British Pound is losing momentum quickly once again as energy concerns are returning to the foreground.

- While far removed from its yearly low after the Bank of England’s intervention last week, the British Pound still remains in a technically weak position.

- Recent changes in retail trader positioning suggest a mixed bias for each of EUR/GBP, GBP/JPY, and GBP/USD rates.

Not Out of the Woods

Despite the Bank of England’s intervention efforts last week, the British Pound is starting to weaken once more. To be clear, the BOE’s sudden QE announcement has relieved a great deal of pressure that had built up after the Truss government’s mini-budget announcement; for now, a collapse of the UK pension system seems to be averted.

But the UK is still facing a very difficult economic situation. For the past several months, we’ve highlighted the growing stagflation risk to the UK economy, and in turn, the British Pound. A rising unemployment rate, multi-decade highs in inflation, and an economy in contraction make for a nasty mix that leaves UK policymakers with few good options.

GBP/USD RATE TECHNICAL ANALYSIS: DAILY CHART (June 2021 to October 2022) (CHART 1)

After setting fresh yearly and all-time lows last week, GBP/USD rates staged an impressive rebound. But the rally appears to have lost steam, with the pair back below the 23.6% Fibonacci retracement from the 2021 high/2022 low range. Likewise, momentum is starting to rollover. GBP/USD rates are back below their daily 5-, 8-, 13-, and 21-EMAs, although the EMA envelope is not yet in bearish sequential order. Daily MACD’s move higher below its signal line is fading, while daily Slow Stochastics are on the cusp of falling out of oversold territory. As has been the case since mid-July, “a ‘sell the rally’ mindset remains appropriate.”

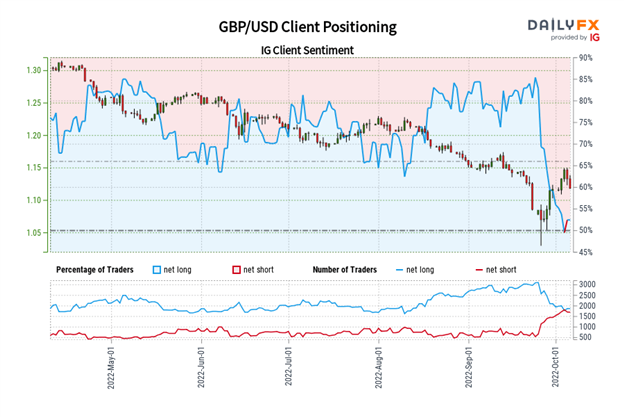

IG Client Sentiment Index: GBP/USD RATE Forecast (October 6, 2022) (Chart 2)

GBP/USD: Retail trader data shows 52.71% of traders are net-long with the ratio of traders long to short at 1.11 to 1. The number of traders net-long is 7.13% higher than yesterday and 17.08% lower from last week, while the number of traders net-short is unchanged than yesterday and 31.79% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.

Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/USD trading bias.

GBP/JPY RATE TECHNICAL ANALYSIS: DAILY CHART (October 2021 to October 2022) (CHART 3)

GBP/JPY rates have lost ground rapidly in the latter half of the week, retracing the gains seen on Monday and Tuesday. While momentum still has a bullish hue, it is quickly fading. If a more considerable pullback is to transpire, it will likely take a move back below the 50% Fibonacci retracement of the 2015 high/2020 low range around 159.94, which served as support from June through late-September. A return to the yearly low below 149.00 – which was achieved and reversed in less than two weeks – seems out of the question in the near-term.

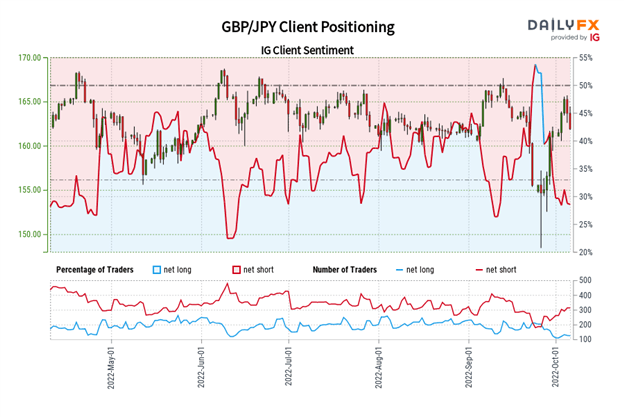

IG Client Sentiment Index: GBP/JPY Rate Forecast (October 6, 2022) (Chart 4)

GBP/JPY: Retail trader data shows 30.47% of traders are net-long with the ratio of traders short to long at 2.28 to 1. The number of traders net-long is 33.96% higher than yesterday and 21.55% lower from last week, while the number of traders net-short is 0.92% lower than yesterday and 42.11% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/JPY prices may continue to rise.

Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/JPY trading bias.

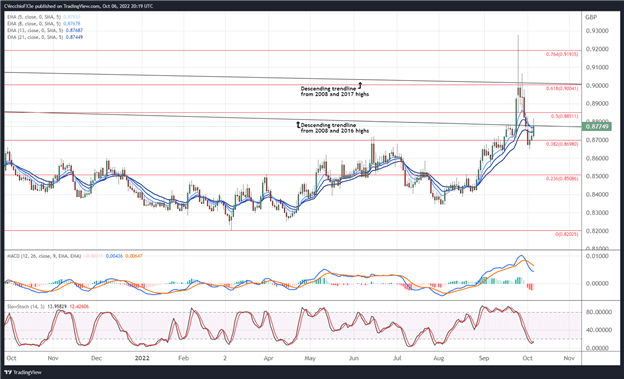

EUR/GBP RATE TECHNICAL ANALYSIS: DAILY CHART (October 2021 to October 2022) (CHART 5)

EUR/GBP rates are starting to grind higher once more, attempting to clear the descending trendline from the 2008 and 2016 highs. Like other GBP-crosses, the pair doesn’t have a consistent tone among its momentum indicators given the sharp reversal seen following the BOE’s QE announcement last week. That said, the seeds are planted for another swing higher in the near-term. Resistance lies above at 0.8851 (the 50% Fibonacci retracement of the 2020 high/2022 low range) and near 0.9004 (the descending trendline from the 2008 and 2017 highs as well as the 61.8% Fibonacci retracement of the 2020 high/2022 low range).

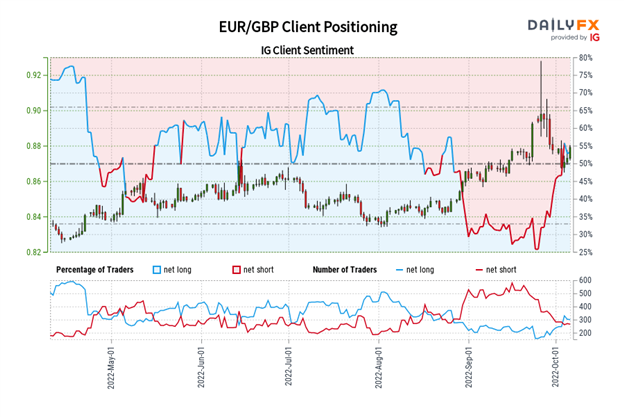

IG Client Sentiment Index: EUR/GBP Rate Forecast (October 6, 2022) (Chart 6)

EUR/GBP: Retail trader data shows 52.45% of traders are net-long with the ratio of traders long to short at 1.10 to 1. The number of traders net-long is 1.59% lower than yesterday and 39.64% higher from last week, while the number of traders net-short is 4.07% higher than yesterday and 14.85% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/GBP prices may continue to fall.

Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/GBP trading bias.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

--- Written by Christopher Vecchio, CFA, Senior Strategist