Sterling (GBP) Price, Chart and Analysis

- GBPUSD back above 1.2720 and at a 10-day high.

- UK Services PMI beat expectations but outlook still gloomy.

Q2 2019 GBP and USD Forecasts andTop Trading Opportunities

Sterling Boosted by Better-Than-Expected Services PMI Data

After disappointing UK Manufacturing and Construction PMIs earlier this week, the important Services data beat market expectations – 51.0 vs exp of 50.6 and prior 50.4 - although the increase was modest, highlighting the ongoing cautious mood in the sector. The UK Composite index slipped to 50.7 missing expectations of 51.0 and a prior month’s 50.9 mainly due to a weaker UK Manufacturing read.

Sterling (GBP) Manages to Continue its Recovery Despite Dismal UK Manufacturing PMI

According to Chris Williamson at data provider IHS Markit, ‘The PMI surveys collectively indicated that the UK economy remained close to stagnation midway through the second quarter as a result, registering one of the weakest performances since 2012’.

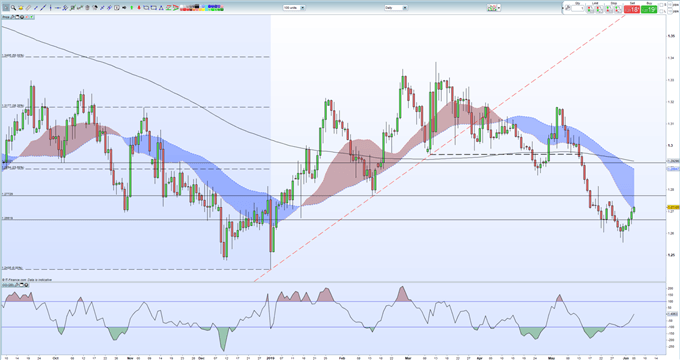

GBPUSD pushed higher post-release, aided in part by a weaker US dollar, trading at a new 10-day high. The USD has weakened sharply over the recent days after various Fed speakers recently suggested that the next move in US interest rates is lower with financial markets now looking for at least two 0.25% rate cuts this year. Global growth expectations have also been pared back with the World Bank Tuesday trimming its latest global growth expectations by 0.2% to 2.7% in 2019.

IG Client Sentiment data paints a negative picture for the pair with 81.5% of traders long GBPUSD, a bearish contrarian bias signal. However, recent daily and weekly positional changes give us a stronger bearish trading bias for GBPUSD.

GBPUSD Daily Price Chart (September 2018 – June 5, 2019)

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on GBPUSD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.