GBPUSD Talking Points:

- GBPUSD is softening after a strong four-day push, with resistance showing at the 14.4% retracement of the January bullish trend. Aiding in that pullback is US Dollar strength being driven from today’s release of FOMC meeting minutes from the January rate decision.

- Brexit remains a difficult driver to work with and the prospect of longer-term trend substantiation can remain as a challenge around GBP-pairs in the near-term. But, given the volatility that’s continued to show around the currency, the door can remain open for short-term strategies utilizing support and resistance levels in order to reinforce strong risk-reward ratios.

- DailyFX Forecasts are available on a variety of currencies such as the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Do you want to see how retail traders are currently trading the US Dollar? Check out our IG Client Sentiment Indicator.

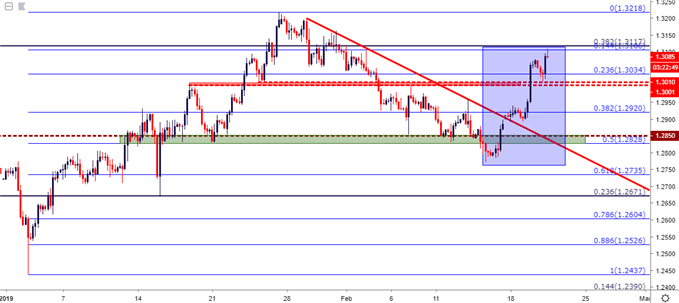

GBPUSD Backtracks After Testing Fibonacci Resistance

The British Pound is pulling back after testing above the 1.3100 level earlier this morning. This capped a strong topside run that showed up after the print of a fresh low less than a week ago. The month of January brought a stretch of strength into GBPUSD that likely caught many by surprise, especially considering the way that the year started for the pair: GBPUSD put in a rather large drop on January 3rd, slipping below 1.2500 temporarily as bears made a push. But the rest of January was marked by recovery, as GBPUSD climbed back above the 1.3000 psychological level to test above 1.3200.

As looked at last week, prices began soften from that bullish theme in the final week of January. And that pullback ran for more than a couple of weeks as GBPUSD tested below the 50% marker of the January bullish run. But since then, buyers have made a pronounced entrance back into the equation, particularly over the past two days of price action, helping to firm prices back above the 1.3000-handle.

GBPUSD Four-Hour Price Chart

Chart prepared by James Stanley

At this point, prices have vaulted into another area of potential resistance, as the space between 1.3106-1.3117 has two different Fibonacci levels of interest. The 1.3106 level is the 14.4% retracement of the January bullish move, while 1.3117 is a longer-term level as the 38.2% marker of the ‘Brexit move’ in the pair.

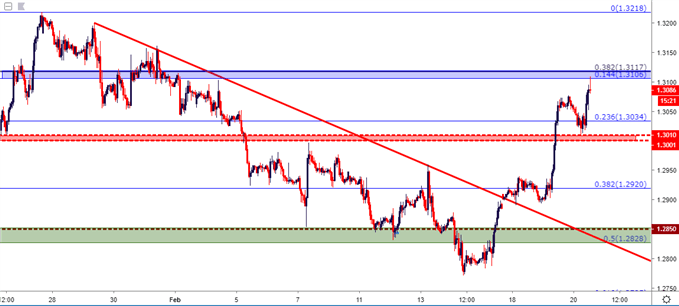

GBPUSD Hourly Price Chart

Chart prepared by James Stanley

GBPUSD Strategy

As discussed over the past few weeks, traders will likely want to continue to limit strategy around GBP-pairs to shorter-term variants, as the volatile nature of the backdrop around the British Pound can continue to evoke turns in either direction. Short-term strategies utilizing support and resistance levels to reinforce advantageous risk-reward ratios appears to be a prudent way of approaching matters in the near-term.

On the below hourly chart are a number of potential levels on either side of current price. For resistance, the zone that’s eliciting the current reaction remains relevant and that rests from 1.3106-1.3117. A bit higher at 1.3160 is the January 31st swing-high, and above this is the 2019 high at the 1.3218 marker that came into play a few weeks ago. For support, the next area of focus is 1.3000-1.3034, which helped to hold the lows earlier this morning. Below that is a zone that runs from 1.2893-1.2920, which currently marks this week’s swing low; and underneath that area is the same 1.2828-1.2850 area that was looked at last week.

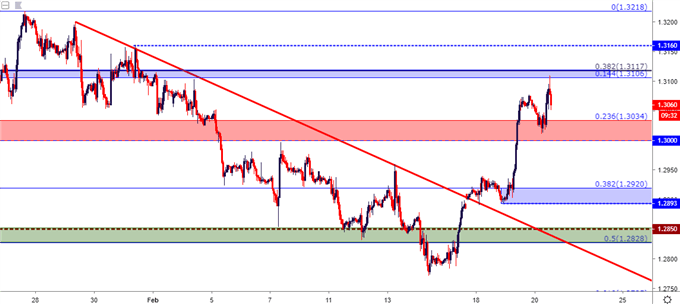

GBPUSD Hourly Price Chart

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts for Q1 have a section for each major currency, and we also offer a plethora of resources on USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers a plethora of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX