To receive James Stanley’s Analysis directly via email, please sign up here.

Talking Points:

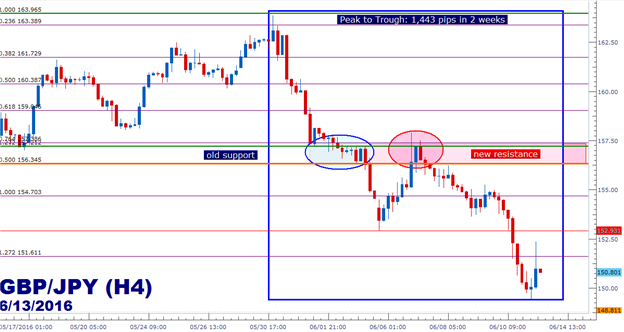

- GBP/JPY Technical Strategy: Down-trend back as fresh 20-month low was set upon market open this week.

- GBP volatility is intense as driven by Brexit Polls, and Yen-strength has been rising as we near the next BoJ rate decision.

- If you’re looking for additional trade ideas, check out our Trading Guide and if you’re looking for shorter-term ideas, check out our SSI indicator.

In our last article, we looked at an aggressive move in the British Pound against the Japanese Yen as it looked as though the previously-predominant down-trend was on it’s way back into GBP/JPY. At the time of that writing, GBP/JPY had fallen by over 600 pips into a critical support zone at the ~157.25 area on the chart. But support didn’t hold for long, and since that article, we’ve seen GBP/JPY fall by another 700+ pips down to another big psychological support level at 150.

GBP/JPY is in the midst of being hit by a perfect storm of headline volatility: A continuation of Brexit fears being driven by a series of volatile polls combined with a surging Japanese Yen on the back of safe-haven demand and fears that the Bank of Japan may be running out of options (if they hadn’t already) has been creating even more out-sized moves in GBP/JPY. And given that this is GBP/JPY, which has a penchant for volatility even in normal circumstances, that’s really saying something.

Expect the potential for volatility in GBP-pairs to remain elevated until after the Brexit referendum.

The current seutp in GBP/JPY is bearish as a fresh 20-month low printed earlier today after this week’s open. Price action posed a quick-breech of the 150-pscyhological level before catching a bounce. Selling at this stage can present challenges from a risk management standpoint, as the prior swing-high in the pair (on the 4-hour chart) is above 155.25, which is approximately 440 pips from current market price at the time of this writing. Traders looking to get short could wait for resistance to show a bit deeper, with eyes on the zone from 152.50-153, as this contains the next higher psychological level (152.50) as well as the prior price action swing-low (152.93).

Should resistance develop in this region, traders may be able to look for a down-side resumption move with targets cast towars the 150-psychological level.

Created with Marketscope/Trading Station II; prepared by James Stanley

--- Written by James Stanley, Analyst for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX