Talking Points

- CAC 40 Opens Up Higher, +0.83% on the Session

- Bullish Breakouts for the CAC 40 Begin Above 4,355.20

- If you are looking for more trading ideas for equities markets, check out our Trading Guides

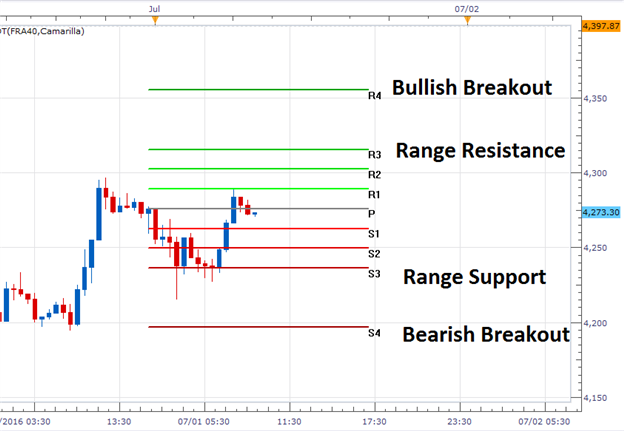

The CAC 40 has opened higher this morning, and is trading up +0.83% on the session. The Index has risen modestly after prices bounced from today’s S3 value of support at 4,236.40. If prices continue to push higher, traders should look for resistance near 4315.60. This area is represented in the graph below at the R3 pivot, and represents range resistance for today’s trading.

CAC 40, 30 Minute Chart with Pivots

(Created using Marketscope 2.0 Charts)

In the event that price action breaks from the previously described pivot range, traders may look for price breakouts either above the R4 or below the S4 pivot. The R4 pivot for today is found at 4,355.20. A move above this value would be significant, as it would be the 4th attempted bullish breakout for the CAC 40 over the last 4 trading sessions. Alternatively, bearish breakouts may be triggered below the S4 pivot at 4,196.80. A move below this point would be the week’s first bearish breakout.

Find out real time sentiment data with the DailyFX’s sentiment page.

Sentiment for the CAC 40 (Ticker: FRA40) remains positive with SSI (speculative sentiment index) increasing to +1.94. 66% of positioning is now long, which may suggest further declines for the CAC 40. In the event of a price decline traders should look for SSI to move to a positive extreme of +2.0 or greater. Alternatively if prices continue to trade higher, traders should look for SSI to move towards more neutral values.

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page.

Contact and Follow Walker on Twitter @WEnglandFX.