EURUSD Price, Chart and Analysis:

- EURUSD fails to hold Wednesday’s flip-up and nears 1.1200 again.

- Wider German-Italy 10-year yield spreads a negative for EURUSD.

Q2 2019 EUR Forecast and USD Top Trading Opportunities

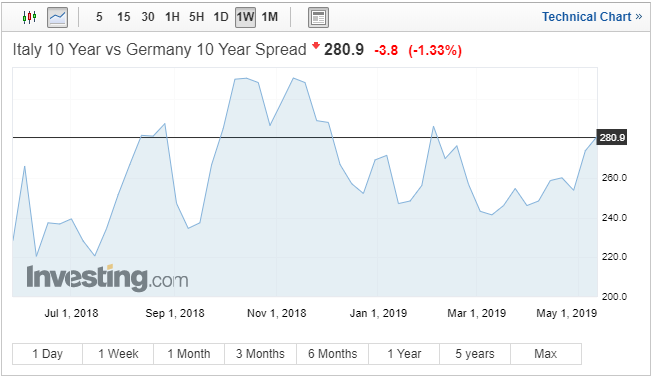

The closely watched Italy/German 10-year yield spread is pushing wider and remains a handful of basis points away from wides last seen in early December 2018, indicating heightened nervousness after comments from Italian deputy PM Matteo Salvini on Wednesday suggested that he would be prepared to break EU fiscal rules to drive unemployment lower. The differential between the two government benchmark bonds is widely followed by EUR traders and the wider the yield spread goes, the more the single currency comes under pressure. In recent months a spread of 330 basis points or more starts alarm bells ringing over Italian debt.

Italy-German 10-Year Bond Yield Spread

Keep up to date with all key economic data and event releases via the DailyFX Economic Calendar

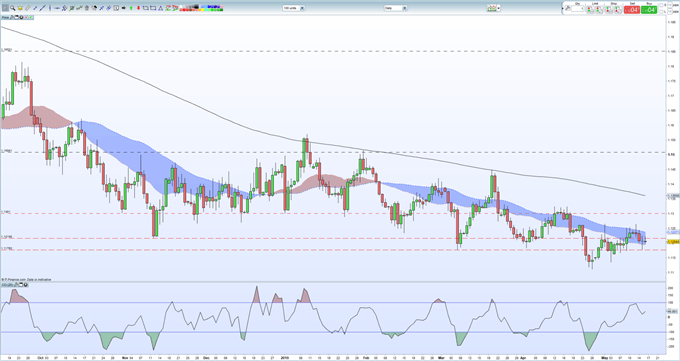

EURUSD continues to struggle to move higher and may re-test recent lows in the coming days. The pair got a 30-40 tick boost yesterday afternoon after the US said it would suspend tariffs on EU and Japanese autos, but this uptick soon faded all the way back, indicating a lack of any real bullish intent. Any upside move will find resistance from a recent double-top around 1.1265 before 1.1300 and 1.1322 come into play. To the downside, the May 9 low at 1.1174 guards 1.1135 and 1.1110, the recently made two-year low.

EURUSD Daily Price Chart (September 2018 – May 16, 2019)

Retail traders are 52.2% net-long EURUSD according to the latest IG Client Sentiment Data, a bearish contrarian indicator. However recent daily and weekly positional changes give us a stronger contrarian bearish bias.

We run several Trader Sentiment Webinars every week explaining how to use IG client sentiment data and positioning when looking at a trade set-up. Access the DailyFX Webinar Calendar to get all the times and links for a wide range of webinars.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on EURUSD – bullish or bearish? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.