EUR/USD Technical Strategy: Flat

- Euro breaks 2-month trend resistance, hinting at further gains ahead

- Longer-term positioning suggests near-term gains probably corrective

- Profit booked on short trade, waiting for rebound to top for re-entry

Build confidence in your Euro trading strategy with our free guide!

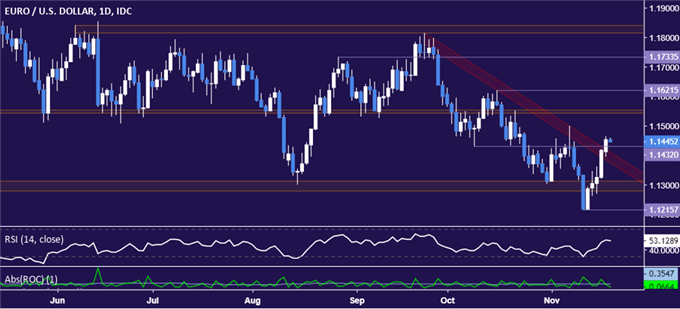

The Euro has breached resistance guiding it lower against the US Dollar since late September, hinting a larger advance may be in the cards. From here, a daily close above the 1.1543-54 chart inflection area exposes minor resistance levels marked by October 16 and August 28 highs at 1.1622 and 1.1734, respectively. A pivotal range top follows in the 1.1815-40 zone.

The outer layer of resistance-turned-support is now at 1.1374. A turn back below that – likewise confirmed on a daily closing basis – would put the 1.1314-1.1279 region back in play. Pushing through that as well would put the November 12 swing low back into the spotlight.

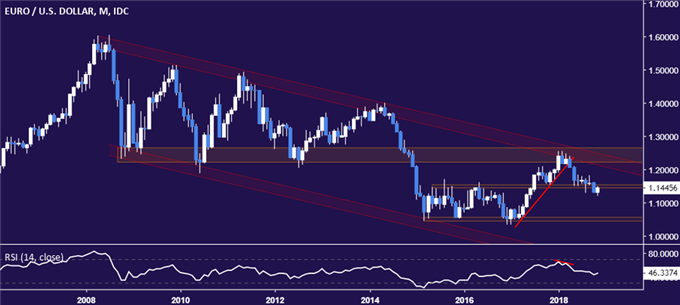

Turning to the monthly chart for a bit of perspective, further gains from here still look to be corrective within a broader downtrend defining Euro price action for over a decade. In fact, October’s breach of support in the 1.1449-54 area seems to suggest that the next leg in this structural decline may be underway already, even if it is yet to show up in near-term positioning.

The tactical implications of the current setup are two-fold. First, profit has been booked on the short EUR/USD trade initiated at 1.1708 and then scaled up, first at 1.1468 and subsequently at 1.1242. Second, any on-coming gains from here will be monitored for signs of topping in search of an opportunity to re-enter short in line with the overall trend bias once the current upswing is exhausted.

EUR/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Trading Q&A webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter