EUR/USD Technical Strategy: NET SHORT AT 1.2276

- Euro may be ready to resume down trend versus US Dollar

- Counter-trend line break to put support above 1.16 in focus

- Looming ECB rate call warns against adding to short trade

See our free guide to get help building confidence in your EUR/USD trading strategy !

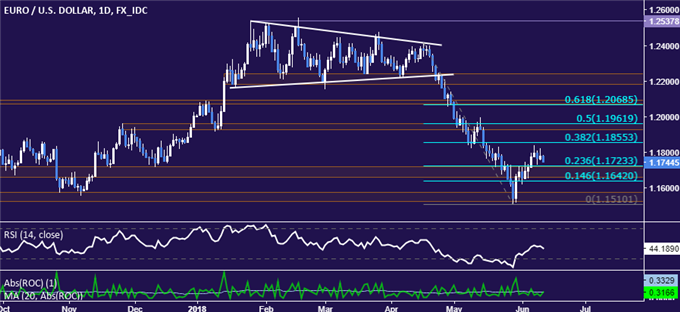

The Euro may be on the verge of resuming the down move started in mid-May against the US Dollar following a brief corrective upswing. Looking at the four-hour chart, prices are on the verse of clearing counter-trend support after failing to breach resistance in the 1.1821-47 area.

Zooming out to the daily chart, a down move that takes prices back below the 1.1642-1.1723 area marked by the 14.6% and 23.6% Fibonacci retracement levels would open the door for another challenge of the 1.1527-77 zone. This is reinforced by the May 29 low at 1.1510.

The EUR/USD short trade started from 1.2407 and thereafter scaled up near the 1.19 figure continues to be in play with net cost basis of 1.2276. Building out larger exposure upon confirmation of the counter-trend break is compelling but the looming ECB rate decision argues for caution. The trade will remain as-is for now, with a stop-loss to be activated on a discretionary basis.

EUR/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Trading Q&A webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter