To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- EUR/USD Technical Strategy: Flat

- Euro posts biggest gain in 2 months vs US Dollar after Flag pattern breakout

- Confirmation, improved risk/reward settings needed for actionable trade setup

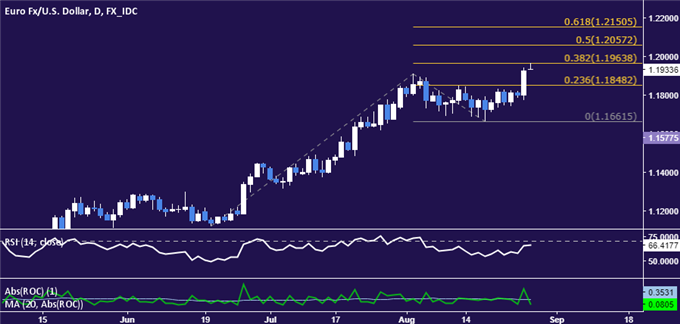

The Euro posted the largest daily gain in two months against the US Dollar, clearing the swing high set in early August and hinting the rising trend launched in mid-April is resuming. The move higher follows the currency pair’s completion of a bullish Flag chart pattern, as expected.

From here, a daily close above the 38.2% Fibonacci expansion at 1.1964 opens the door for a challenge of the 50% level at 1.2057. Alternatively, a reversal back below the 23.6% Fib at 1.1848 paves the way for a retest of the August 17 swing low at 1.1662.

Current positioning does not seem to offer an actionable trade setup. Prices are too close to immediate resistance to justify getting long from a risk/perspective whereas the absence of a defined bearish reversal warns that taking up the short side is premature. On balance, staying flat seems most prudent for now.

Have a question about trading EUR/USD? Join a Q&A webinar and ask it live!