To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- EUR/USD Technical Strategy: Flat

- Euro makes a bid for uptrend resumption with bullish Flag pattern break

- Short position unwound as heavy-duty fundamental event risk looms ahead

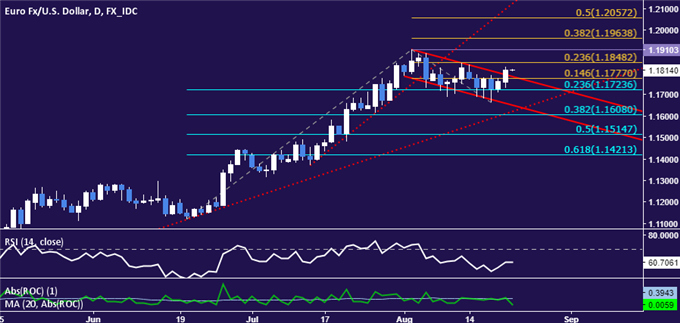

Euro technical positioning may be signaling that the rising trend launched from April lows against the US Dollar is resuming after a brief retracement. Prices look to have competed a bullish Flag continuation pattern, painting the three-week downturn from August highs as a correction that has ended.

Near-term resistance is now at 1.1848, the 23.6% Fibonacci expansion, with a break above that on a daily closing basis opening the door for a test of the August 2 high at 1.1910. Alternatively, a reversal back below the 14.6% expansion at 1.1777 exposes the 23.6% Fib retracement at 1.1724 anew.

While the short EUR/USD trade triggered at 1.1809 has not triggered its stop-loss, the overall chart setup warns against holding on to the position, especially with heavy-duty fundamental event risk on the horizon. With that in mind, exposure has been unwound with a small loss until a better setup emerges.

What is the #1 mistake traders make, and how do you fix it? Find out here !