To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- EUR/USD Technical Strategy: Short at 1.1317

- Euro may correct higher after hitting two-month low vs. US Dollar

- Gains to be treated as corrective, offering chance to add to short trade

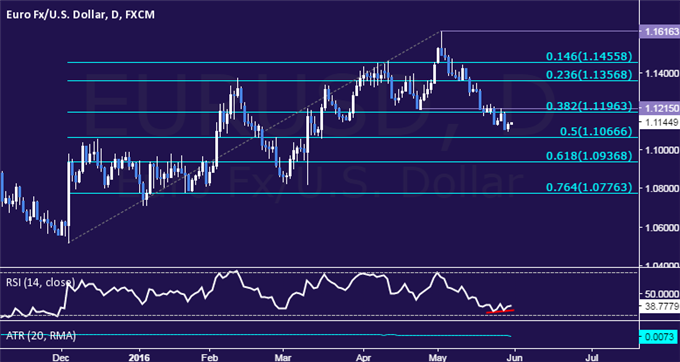

The Euro continues to edge lower against the US Dollar, with prices descending to the lowest level in over two months having topped as expected near 1.16. The emergence of positive RSI divergence now hints at ebbing downside momentum and suggests that a recovery may be brewing ahead.

A reversal back above support-turned-resistance marked at 1.1215, the April 25 low,opens the door for a test of the 23.6% Fibonacci retracement at 1.1357. Alternatively, break below N the 50% level at 1.1067 on a daily closing basis clears the way for a challenge of the 61.8% level at 1.0937.

A EUR/USD short trade at 1.1317 hit its initial target at 1.1215, with partial profits taken and the stop-loss trailed to breakeven on remaining exposure. A recovery from current levels will be treated as corrective for the time being, offering an opportunity to add to the short exposure once the upswing fizzles.

FXCM traders are net buyers of the Euro. Find out here what this hints about the price trend!