To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- EUR/USD Technical Strategy: Short at 1.1317

- Euro issues the largest daily drop in a month against the US Dollar

- Partial profits taken after short position hits first target above 1.12

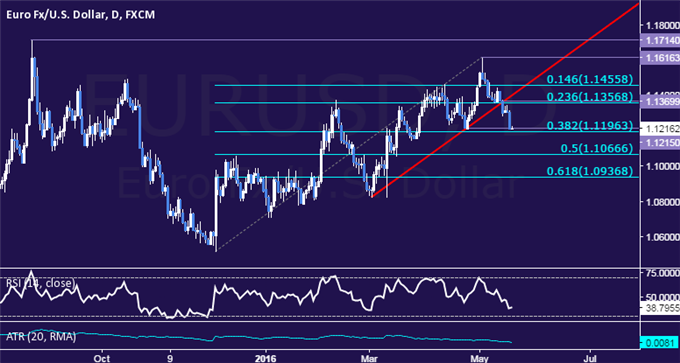

The Euro turned sharply lower against the US Dollar, with prices issuing the largest one-day decline in a month and establishing a foothold below the 1.13 figure. The single currency established a top after producing a Shooting Star candlestick on a test of the 1.16 mark, as expected.

From here, a daily close below the 1.1196-1.1215 area (38.2% Fibonacci retracement, April 25 low) clears the way for a challenge of the 50% level at 1.1067. Near-term support is at 1.1357, the 23.6% Fib, with a move back above that seeing the next upside barrier at 1.1456 marked by the 14.6% retracement.

A short EUR/USD trade was triggered at 1.1317. Prices have now hit the initial target at 1.1215 and half of the position has been booked. The remainder of the trade will remain active to capture any further weakness. The stop-loss has been adjusted to the breakeven level.

Retail traders are net-short the Euro.What does that mean for the trend? Find out here !