To receive James Stanley’s Analysis directly via email, please sign up here.

Talking Points:

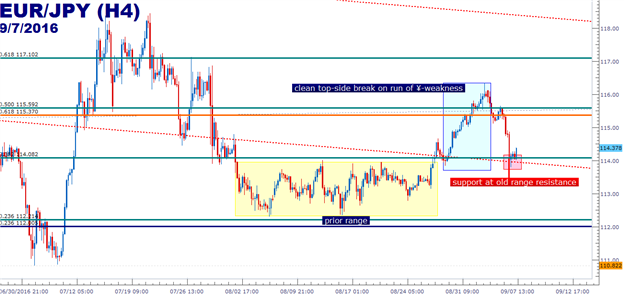

- EUR/JPY Technical Strategy: Range discussed in last article saw top-side break, now Support showing at Old Resistance.

- EUR/JPY could see an increase in volatility around tomorrow’s European Central Bank announcement.

- If you’re looking for trading ideas, check out our Trading Guides. And if you want something more short-term in nature, check out our SSI indicator.

In our last article, we looked at the relatively consistent range that had built-in throughout the month of August in EUR/JPY. And while this range was fairly well-constructed and remained within pre-defined support and resistance levels, the prospect of playing a range in either the Euro or the Yen may have caught quite a few traders by surprise, especially given the potential for macro drivers behind each represented currency.

We began to see this price-in as markets ushered towards a September that would bring ‘big’ Central Bank meetings from both the U.S. and Japan; and EUR/JPY staged a top-side breakout as Yen-weakness began to show. This theme of Yen weakness wasn’t relegated to just the Euro, as it appeared as though anticipation of another move from the BoJ at their next meeting was eliciting pre-emptive Yen-selling.

The start of this week saw the brakes get tapped on that theme as the Yen has reversed a portion of those losses; and this has helped to bring EUR/JPY back down to support around 114.08, which is the 38.2% Fibonacci retracement of the ‘Brexit move’ in the pair, taking the high and low from June 24th’s price action. Traders looking to get long in the pair can use this as a basis for top-side entry, with potential support showing up around old, prior range resistance.

Charts prepared by James Stanley

With the European Central Bank on the docket for less than 24-hours from now, traders would likely want to incorporate a potential for an increase in volatility. As in, be careful of tight stops as whipsaw around the announcement could trigger the trader out of a position before the setup ever has a chance to ‘work.’ We discussed what this ECB meeting might bring in this week’s forecast on the Euro; and likely we’re looking at either an extension of QE beyond its current March 2017 end-date, or nothing at all. And as we said in the forecast, it may make more sense for the ECB to keep some ‘powder dry’ with the aim of making that extension announcement in December.

If the ECB does not extend QE at tomorrow’s meeting, we could see the bullish run in EUR/JPY continue as we approach the widely-awaited September Bank of Japan meeting.

--- Written by James Stanley, Analyst for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX