EURGBP TECHNICAL ANALYSIS

- EURGBP is now testing critical support at 0.9039

- Will break below price floor could trigger selloff?

- Was EU politics behind GBP spike, EUR decline?

See our free guide to learn how to use economic news in your trading strategy !

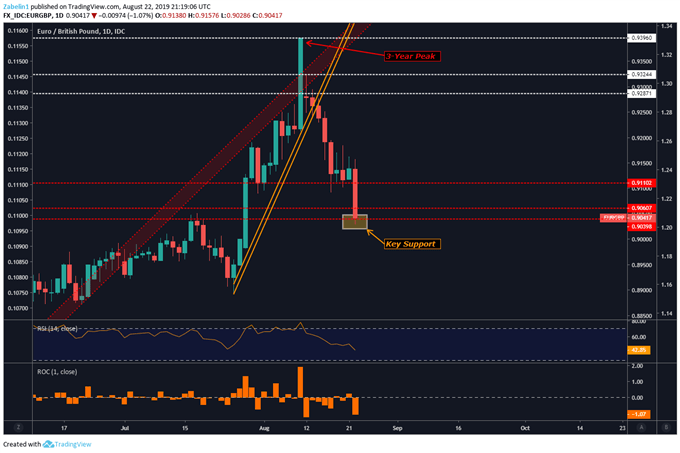

After climbing for 14 consecutive weeks, EURGBP has declined over three percent after reaching its 3-year peak in early August. The pair is now testing key support at 0.9039 after breaking below two of the other support-now-turned resistance levels. A break below 0.9039 with follow-through could trigger a selloff and amplify the pair’s retreat.

EURGBP – Daily Chart

EURGBP chart created using TradingView

The pair’s sudden decline could be attributed to recent political developments in Europe that have proved more favorable to Sterling (Brexit) and detrimental to the Euro (Italy risk). Traders may wait to commit capital until the pair either show signs of a recovery or displays a clear downward bias as a directional preference.

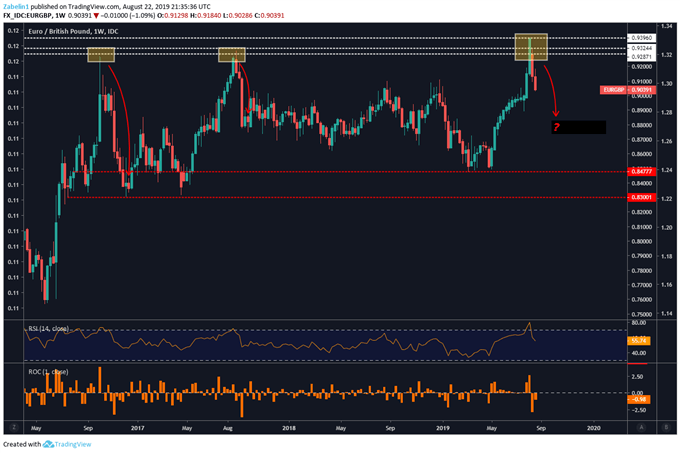

EURGBP – Weekly Chart

EURGBP chart created using TradingView

Zooming out to a weekly chart shows since 2016, whenever the pair reached these highs it was followed by a significant decline. However, it is important to remember: past performance is not indicative of future results. Having said that, traders with long positions may be hesitant to add exposure since these resistance levels (white dotted lines) have proved themselves to be formidable. But that is not to say they are insurmountable.

EURGBP TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter