EUR/GBP Technical Analysis

- EUR/GBP dominant downtrend at risk

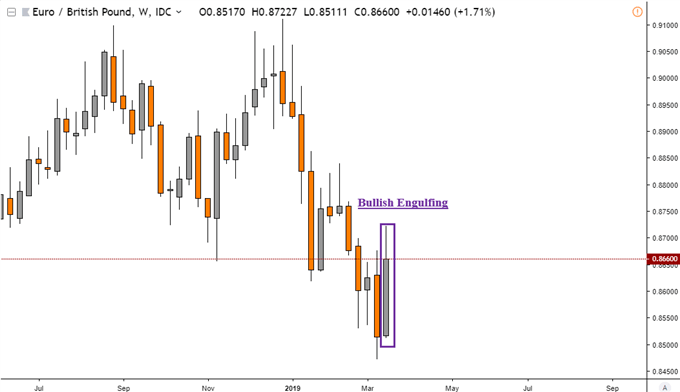

- Weekly chart has bullish reversal hints

- January resistance trend line breached

Just started trading EUR/GBP? Check out our beginners’ FX markets guide !

The Euro is making a comeback against the British Pound, with Sterling fundamentally weighed down by the latest Brexit developments. Previously, I noted that the weekly and daily EUR/GBP charts were giving conflicting technical signals. It now appears that the bullish ones in the latter are prevailing and the dominant downtrend from the beginning of this year may be at risk.

Looking at the weekly EUR/GBP chart below, a bullish engulfing candlestick appears to be forming at the recent bottom. Achieving a close above the prior open at 0.8630 will solidify its creation. Subsequently closing above it would confirm the reversal pattern, opening the door to further gains. I am closely following EUR/GBP’s performance and you may follow me on Twitter here @ddubrovskyFX to stay updated.

EUR/GBP Weekly Chart

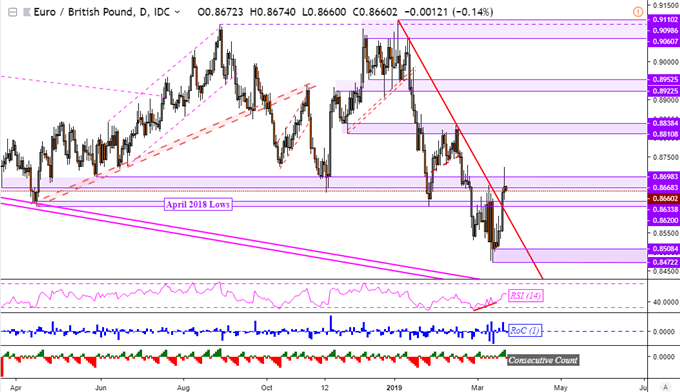

Switching to the daily chart reveals that EUR/GBP has now achieved multiple closes above a falling trend line from the turn of 2019. This resistance has kept its downtrend intact as the pair declined over 6.5%. At the bottom, positive RSI divergence emerged showing that momentum to the downside was fading. This is typically a warning sign that prices may be readying to turn higher.

While closing above the trend line is significant, I would also like to see a push beyond near-term resistance which is a range between 0.8668 and 0.8698. In the past, this area acted as key support since 2018 and it may establish itself as a barrier again. Extending near-term gains would then exposes resistance at 0.8810. Otherwise, immediate support appears to be at 0.8620.

Note for Sterling Traders

For those that are trading the British Pound and GBP/USD, keep a close eye for Brexit updates. Sterling is still anticipated to be the most active major, with implied volatility at 32-month highs. UK Prime Minister Theresa May has been given a third chance by the European Union to pass her divorce plan through Parliament next week. Otherwise, risks of a ‘no-deal’ Brexit could greatly increase.

EUR/GBP Daily Chart

**Charts created in TradingView

FX Trading Resources

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- See our free guide to learn what are the long-term forces Euro prices

- See how the British Pound and Euro are viewed by the trading community at the DailyFX Sentiment Page

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter