To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

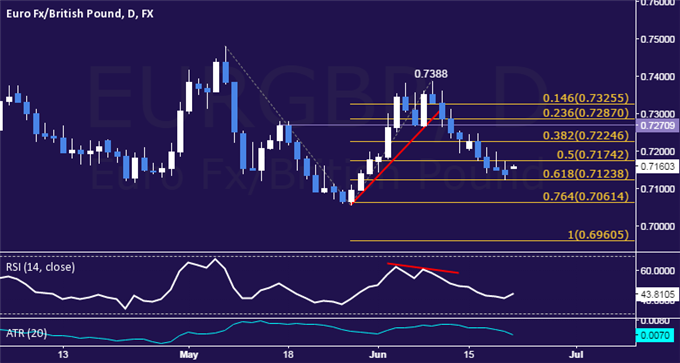

- EUR/GBP Technical Strategy: Flat

- Support: 0.7124, 0.7061, 0.6961

- Resistance: 0.7174, 0.7225, 0.7287

The Euro continues to edge downward against the British Pound, with prices sliding to the weakest level in a month. Near-term support is at 0.7124, the 61.8% Fibonacci expansion, with a break below that on a daily closing basis exposing the 76.4% level at 0.7061. Alternatively, a push above the 50% Fib at 0.7174clears the way for a test of the 38.2% threshold at 0.7225.

Prices are wedged too closely between near-term support and resistance levels to justify taking a trade on a long or short side from a risk/reward perspective. With that in mind, we will continue to stand aside until a more attractive opportunity presents itself.

Add these technical levels directly to your charts with our Support/Resistance Wizard app!

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com