To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

- EUR/GBP Technical Strategy: Flat

- Euro Drops to Lowest in Over Three Months vs. British Pound as Down Trend Resumes

- Risk/Reward Considerations Argue Against Re-Entering Short EUR/GBP Trade for Now

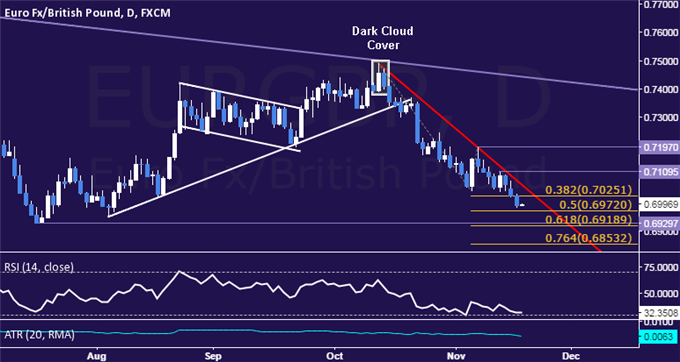

The Euro resumed its decline against the British Pound after a brief bout of sideways consolidation, dropping to the lowest level in over three months. Prices carved out a top having put in a bearish Dark Cloud Cover candlestick pattern below two-year down trend resistance, as expected.

Near-term support is now at 0.6972, the 50% Fibonacci expansion, with a break below that on a daily closing basis clearing the way for a test of the 0.6919-30 area marked by the July 17 low and the 61.8% level. Alternatively, a move back above support-turned-resistance at 0.7025, the 38.2% Fib, sees the next upside barrier at a falling trend line established from mid-October highs, now at 0.7063.

We are keen to re-enter short in line with the long-term down trend having booked profit on our previous position from 0.7325. Prices are too close to immediate support and the available trading range is too narrow to justify pulling the trigger now from a risk/reward perspective. With that in mind, we will remain on the sidelines for now and wait for a better-defined opportunity to present itself.

Losing Money Trading Forex? This Might Be Why.