Talking Points:

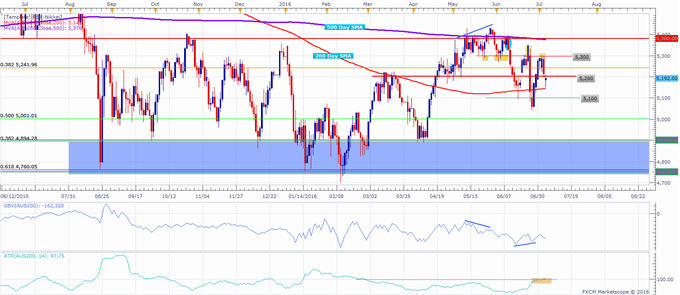

- 5,300 level held as resistance and the index lost some of its gains

- Index bouncing from 200 day moving average areas to test 5,200 for possible resistance

- ATR at the highest level since February, and volatility might stay elevated

Find REAL TIME traders positioning with DailyFX’s SSI Indicator Here

The ASX 200 is seeing a bounce off its 200 day Simple Moving Average as the index lost some of the post-Brexit recovery gains after finding resistance at the 5,300 level.

At this stage, the index is trading around the 5,200 level, which proved influential in the past, and might act as resistance to add for further downside momentum. If the index holds below the level, it may need to find a clear break below the 200 SMA before possible further support at the 5,100 level.

The 5,000 handle lurks below, while a possible support area might sit around the 4,900 level to the 4,750 long term range lows.

A move above 5,200 may put the focus again on the 5,300 level following the long term range top resistance at about 5,380-5,400.

The index might need to break these levels, and the current range “structure”, to signal that the bulls are really back in control.

The ASX has seen volatility pick up after the “Brexit” decision, as ATR readings indicate the most volatile market since February.

ASX 200 Daily Chart: July 6, 2016

--- Written by Oded Shimoni, Junior Currency Analyst for DailyFX.com

To contact Oded Shimoni, e-mail oshimoni@dailyfx.com