AUDUSD TECHNICAL OUTLOOK: BEARISH

- AUDUSD recoils from trend resistance, signals a top is in place

- Near-term support at 0.6827, with 2019 low at 0.6744 following

- Overall chart setup still hints at descent to challenge 0.67 figure

Get help building confidence in your AUDUSD strategy with our free trading guide!

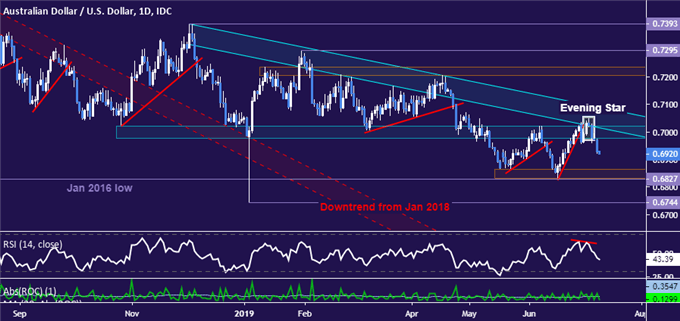

The Australian Dollar tracked lower after a retest of support-turned-resistance at the bottom of a bearish Descending Triangle chart pattern, as expected. Prices attempted to recover after breaking counter-trend support and even managed to set a higher swing top, but the effort fizzled. A bearish Evening Star coupled with negative RSI divergence now reinforces the case for a reversal.

From here, the next significant layer of support seems to be in the 0.6827-65 area, marked by recent attempts to challenge trend-defining support at the January 2016 low. Securing a break below that on a daily closing basis probably opens the door for a challenge of the 2019 spike low at 0.6744. The outermost layer of downward-sloping trend resistance is now at 0.7088.

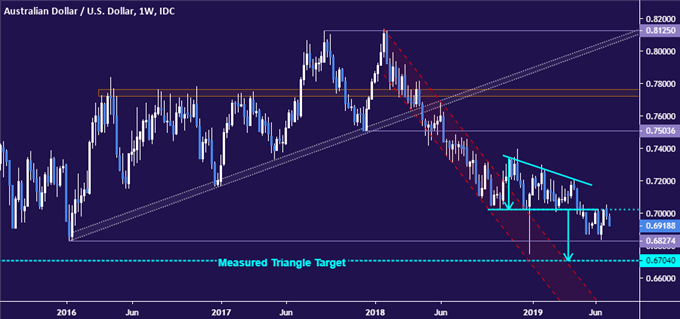

Zooming out to the weekly chart, overall technical positioning continues to suggest the AUDUSD downtrend started in early 2018 has resumed following a period of congestion. While the support at 0.6827 is yet to be broken, measuring the width of the Descending Triangle pattern defining the digestive period prior to breakdown implies a steeper decline to test the 0.67 figure.

AUDUSD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free live webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter