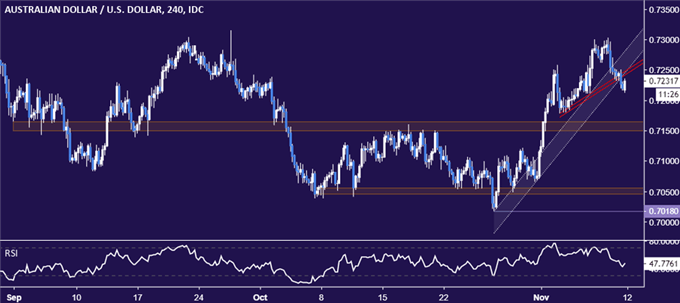

AUD/USD Technical Strategy: SHORT AT 0.7231

- Counter-trend support break hints Aussie Dollar upswing over

- Initial support below 0.72 figure, resistance still just above 0.73

- Short AUD/USD position triggered, initially aiming for 0.7160

Get help building confidence in your AUD/USD strategy with our free trading guide!

The Australian Dollar looks to be resuming the downward trend against it US counterpart following a corrective upswing, as expected. The four-hour chart reveals a breach of counter-trend support guiding the recent recovery, signaling its demise and opening the door for what could become the next leg in the long-term bearish reversal.

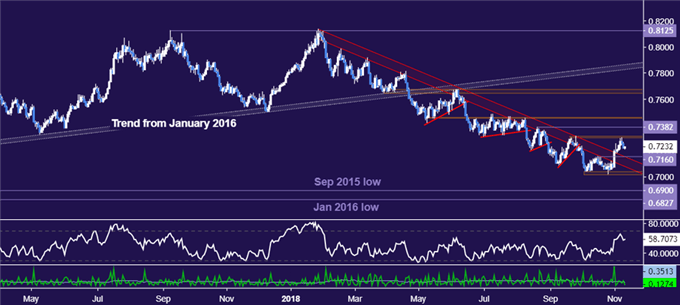

Turning to the daily chart, a daily close below former range resistance at 0.7160 (October 17 high) sees the next major downside barrier in the 0.7021-41 area, the launch pad for the most recent foray higher. Alternatively, a breach above the 0.7304-15 zone targets minor resistance at 0.7382 (August 21 high), followed by a more substantive hurdle in the 0.7452-61 region.

Attractive risk/reward parameters appeared to complement a compelling technical setup and a short AUD/USD position was activated at 0.7231, initially targeting 0.7160 (but with an open longer-term objective). A stop-loss will be triggered on a daily close above 0.7265. Opportunities to scale up exposure will be evaluated on a discretionary basis.

AUD/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Trading Q&A webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter