US Dollar, USD/SGD, USD/THB, USD/PHP, USD/IDR – ASEAN Technical Analysis

- US Dollar pauses its advance against ASEAN currencies

- USD/SGD upside bias remains in play, USD/THB may stall

- USD/PHP enters consolidation as USD/IDR continues ranging

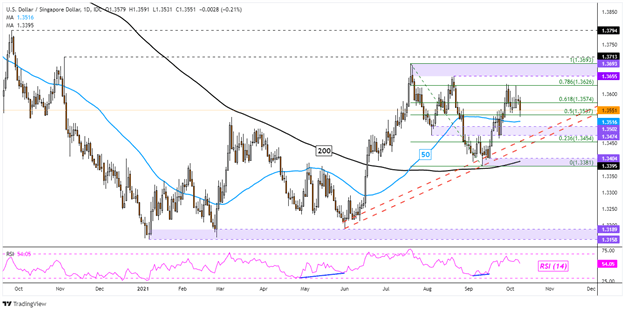

Singapore Dollar Technical Outlook

The US Dollar cautiously weakened against the Singapore Dollar this past week. In fact, the Greenback generally underperformed its ASEAN peers as Emerging Market sentiment recovered. Still, the technical bias in USD/SGD arguably remains tilted higher. Rising support from June seems to be maintaining the upside focus. Immediate support appears to be the 50-day Simple Moving Average. Breaking under it could open the door to testing the trendline. Resuming the uptrend entails taking out the 1.3655 – 1.3693 zone of resistance.

USD/SGD Daily Chart

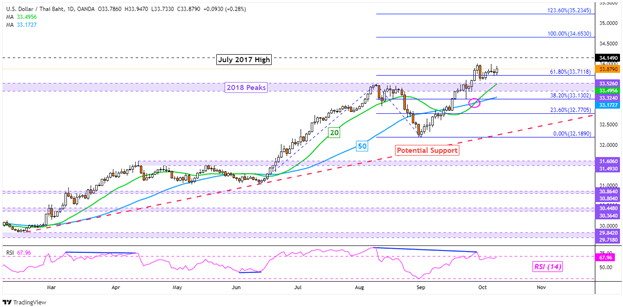

Thai Baht Technical Outlook

The US Dollar slowed its advance against the Thai Baht, but the broader USD/THB uptrend remains intact. Prices are consolidating under the July 2017 high at 34.149. Negative RSI divergence does show that upside momentum is fading. This can at times precede a turn lower. Such an outcome could place the focus on immediate support at 33.711, which is the 61.8% Fibonacci extension. Under that are the 20- and 50-day SMAs. These recently formed a bullish Golden Cross, underpinning a bullish technical bias. Taking these out may open the door to a near-term reversal. Otherwise, taking out the July 2017 high exposes the 100% Fibonacci extension at 34.653.

USD/THB Daily Chart

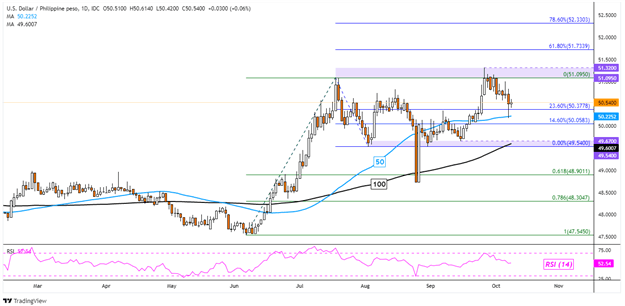

Philippine Peso Technical Outlook

The US Dollar might be entering a consolidative state against the Philippine Peso after USD/PHP rejected the July high. This resulted in the formation of a key zone of resistance between 51.095 and 51.320. The pair appears to be heading towards the 49.54 – 49.67 support zone. Still, the 50-day SMA could play out as support, pivoting the pair back higher. Otherwise, taking it out could increase the chance that USD/PHP falls to the September low. Resuming gains since June would expose the 61.8% Fibonacci extension at 51.733.

USD/PHP Daily Chart

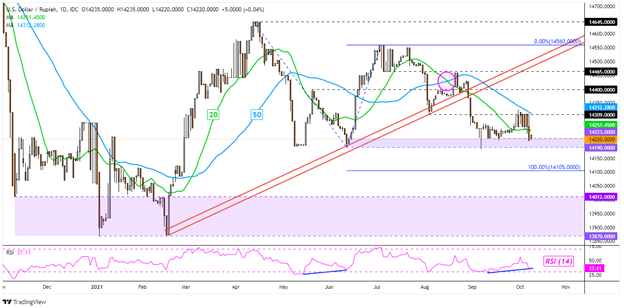

Indonesian Rupiah Technical Outlook

The US Dollar remains pressured against the Indonesian Rupiah. USD/IDR was unable to clear the 50-day SMA. This means the bearish Death Cross between that line and the 20-day equivalent remains in play. Simultaneously, the pair has been unable to make meaningful progress through the 14190 – 14223 support zone. Taking out this range may open the door to extending losses since July towards lows set earlier this year. Otherwise, clearing the 50-day SMA exposes highs from August towards 14560.

USD/IDR Daily Chart

--- Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team