USD/ZAR Highlights:

- USD/ZAR continues 2020 rally to new highs

- Big-picture trend-line, pattern coming into view

USD/ZAR continues 2020 rally to new highs

USD/ZAR continues to chug higher with capital fleeing emerging market currencies into the Dollar. It hasn’t been an extremely strong rise of late, which is one reason why upcoming resistance might keep a lid on a further price advance. For now.

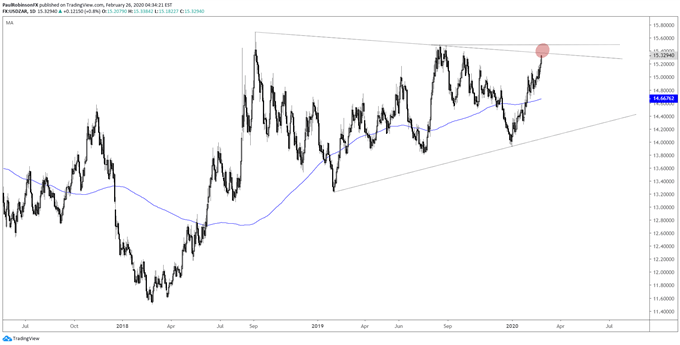

The trend-line running off the September 2018 high over the 2019 high is just ahead around the 15.35 level. If we see a turn down from resistance, the wedge pattern developing since 2018 will continue to mature towards an eventual apex of the pattern.

However, a breakout beyond the trend-line and the 2019 high at 15.49 could quickly have the 2018 high at 15.69 in play. A breakout beyond that point would bring into play the notion of seeing the two-year congestion pattern resolve into a major break towards the spike-high created in 2016 at 17.76.

But before thinking about those lofty levels, we need to first worry about the upcoming test of resistance. A sharp turn lower or volatile series of sessions around resistance would be a solid sign that USD/ZAR is set to trade lower for a bit, perhaps back towards the 200-day MA.

But if a reaction is lacking, i.e. a strong push through resistance, then we can start thinking about the path of least resistance gaining top-side momentum. All-in-all, the long-term outlook looks firmly pointed towards higher levels, but the near-term path could be a bit tricky before a clear path is created. Watching how price action plays out around levels will help provide signposts as to how to navigate.

USD/ZAR Daily Chart (Rising to top of wedge)

USD/ZAR Weekly Chart (long-term outlook tilted bullish)

***Updates will be provided on the above thoughts and others in the trading/technical outlook webinars held at 1030 GMT on Tuesday and Friday. If you are looking for ideas and feedback on how to improve your overall approach to trading, join me on Thursday each week for the Becoming a Better Trader webinar series.

Resources for Forex & CFD Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX