GERMAN BUND, EURO STOXX 50 – Talking Points:

- 10-year German bund may be bottoming as Euro Stoxx 50 forms a top

- Reversals hinted in chart positioning would mark risk-off start to 2020

- Confirmation on breaks of trend-setting technical barriers still pending

Technical positioning in bellwether Eurozone stock and bond benchmarks warns that a broad-based turn in recent price trends may be brewing ahead. If it materializes, the implied reversal would speak to defensive shift in traders’ market outlook.

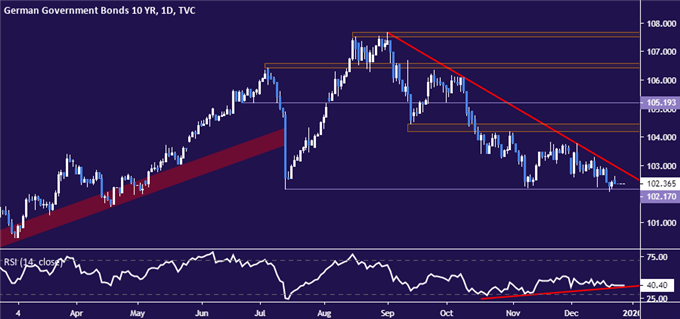

First, Germany’s 10-year Bund – the Eurozone’s go-to regional “safe haven” asset – may be bottoming. The appearance of positive RSI divergence as prices test support at 102.17 suggests downside momentum is ebbing, hinting that an upturn may not be far behind.

Confirmation on a daily close above trend line resistance guiding the move lower since early September – now at 102.81 – would suggest a reversal is underway. Former support in the 104.19-47 zone would then enter the spotlight as the next upside hurdle of significance.

German Bund daily chart created with TradingView

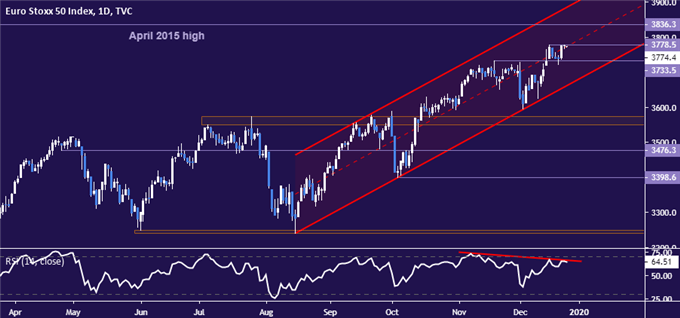

The setup in the Euro Stoxx 50 stock index seems to be showing the mirror image of the same dynamic. Negative RSI divergence on a test of resistance at 3778.50 – the December 16 high – suggests the impetus for gains may be unraveling. This could precede a downturn.

Slipping below resistance-turned-support at 3733.50 would put rising channel support defining the uptrend from mid-August lows in focus. Clearing that barrier on a daily closing basis would then mark confirmation of a sea change, setting the stage for follow-on weakness.

Euro Stoxx 50 daily chart created with TradingView

EURO STOXX 50, BUND TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter