Talking Points:

- Cryptocurrency markets have had a strong start to 2019: Bitcoin is up 44% year-to-date.

- Meanwhile, USDARS is up 19.6% this year, while USDTRY has added 12.2%.

- Since the start of September 2018, the correlation between Bitcoin and USDTRY has been a statistically significant 0.78.

Looking for longer-term forecasts on the US Dollar? Check out the DailyFX Trading Guides.

Cryptocurrency markets have had a decently strong start to 2019 have a putrid 2018. Last year saw Bitcoin prices lose over -72% over their value, in line with performance seen in Litecoin (-86%), Ether (-81%), and Ripple (-81%), among others.

One possible explanation may be that much of 2018 was marked by steady improvement in demand for risky assets; safe haven currencies like the Japanese Yen and US Dollar were out of vogue up until September 2018.

Cryptocurrency Markets Have Had a Good 2019 So Far

Starting in September 2018, cryptocurrency markets started to turn around, in part, it appears, due to a desire for safe haven assets – but specifically, emerging market investors seeking foreign assets that provided liquidity in non-local denominated currencies.

Pressure in emerging market currencies at the end of 2018 and during the first several months of 2019 have helped propel cryptocurrencies to a strong start this year. Bitcoin prices are up 44% year-to-date while Litcoin prices are up 146%.

Gains May Be Rooted in Developments in Argentina and Turkey

At the start of April, when we last checked in on Bitcoin prices and USDTRY, Turkey had just held local elections. At the time we said that “several minor obstacles appearing at the same time can prove a formidable obstacle.” Now, a new obstacle has appeared: the central bank’s independence appears increasingly under pressure after they decided to remove their rate hike bias.

Per the Emerging Markets Crisis Monitor, central bank independence is a crucial feature of long-term stability for a currency.

Reflecting this new obstacle, traders have pushed Turkish 5-year CDS prices to their highest level since September 2018 – the tail end of the last time EM FX contagion fears roiled currency markets. But it’s not just Turkey: Argentinian 5-year CDS have exploded higher in recent days to indicate the most credit risk since May 2015.

Reflecting economic and political stability, and in turn, the increase in credit risk in recent weeks, USDARS is up 19.6% this year, while USDTRY has added 12.2%.

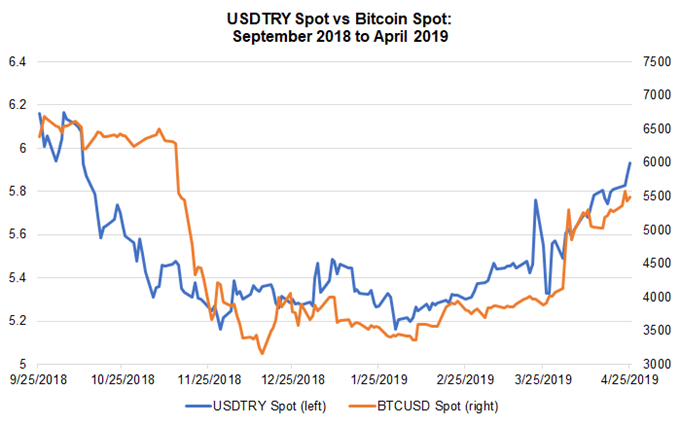

USDTRY vs Bitcoin (BTCUSD) Price Chart: Daily Timeframe (September 2018 to April 2019) (Chart 1)

It still holds that the recent Bitcoin rally has gone together with weakness in EM FX, particularly with the Turkish Lira. Since the start of September 2018, the correlation between Bitcoin and USDTRY has been a statistically significant 0.78. Meanwhile, the rolling one-month and three-month correlations are 0.77 and 0.92, respectively.

In other words, when the Lira has rallied, Bitcoin has weakened (September to December 2018); when the Lira has depreciated, Bitcoin has strengthened (January to present).

It thus still holds that if Bitcoin prices and the cryptocurrency market in general are going to stay with their bullish turn in 2019, the best hope remains more weakness in emerging market currencies like the Argentinian Peso and Turkish Lira.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX