ASEAN Technical Outlook – USD/PHP, USD/SGD, USD/IDR, USD/MYR

- US Dollar may extend gains against the Malaysian Ringgit

- Meanwhile, USD/SGD and USD/PHP may decline instead

- USD/IDR running out of room to consolidate, breakout eyed

Trade all the major global economic data live as it populates in the economic calendar and follow the live coverage for key events listed in the DailyFX Webinars. We’d love to have you along.

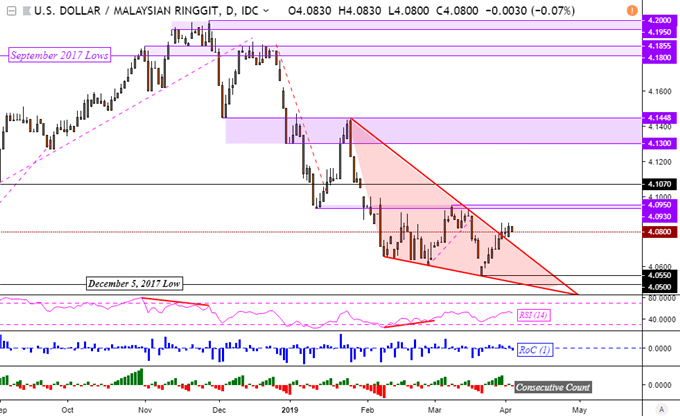

USD/MYR Technical Outlook: Bullish

The Malaysian Ringgit lost ground to the US Dollar over the past five trading days. This followed the formation of a Falling Wedge bullish reversal pattern, as anticipated. USD/MYR has since broken above the ceiling of the candlestick pattern, pushing towards near-term resistance just under 4.0950. While the pair may reach this target in the short-run, it is unclear if prices may push above it at this point. Turning lower has 4.0550 eyed as support in the medium-term.

USD/MYR Daily Chart

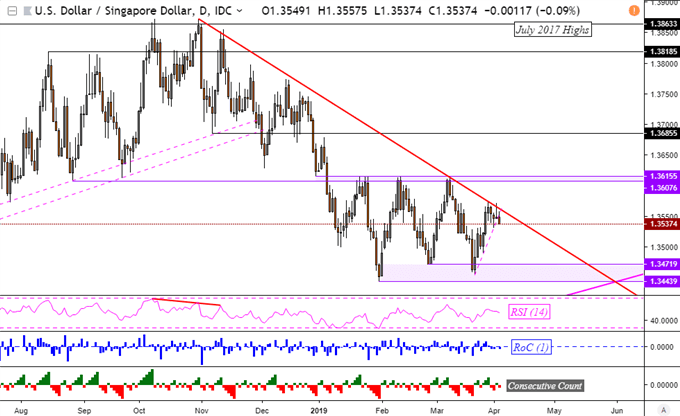

USD/SGD Technical Outlook: Bearish

Meanwhile, USD/SGD was little changed after prices were unable to push above the well-defined falling trend line from November. In the medium-term, the Singapore Dollar has been trading in a range between 1.36155 and 1.34439. After prices bounced at support in late March, it seemed that the next path would have entailed testing resistance again. This has been proven to be difficult. In the near-term USD/SGD fell under a rising support line from late March, perhaps signaling that the floor of consolidation may be tested next.

USD/SGD Daily Chart

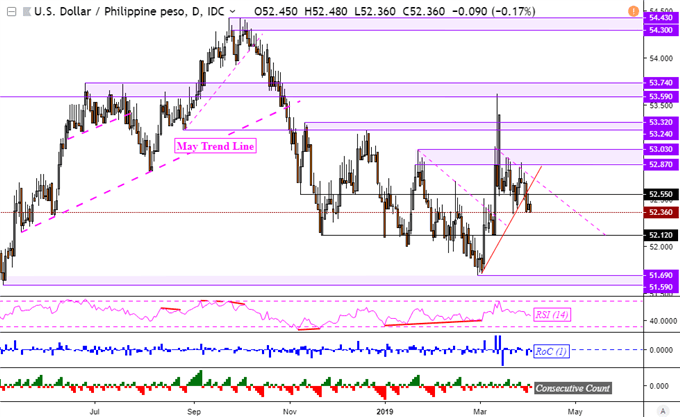

USD/PHP Technical Outlook: Bearish

USD/PHP could be also readying to turn lower in the days ahead. The Philippine Peso took out a rising trend line from March, opening the door to testing support at 52.12 next. If cleared, the pair may then aim for a psychological barrier between 51.59 and 51.69 thereafter. Meanwhile, resistance seems to be at 52.55 followed by a falling trend line from the middle of March. For timely updates on ASEAN FX, follow me on Twitter here @ddubrovskyFX.

USD/PHP Daily Chart

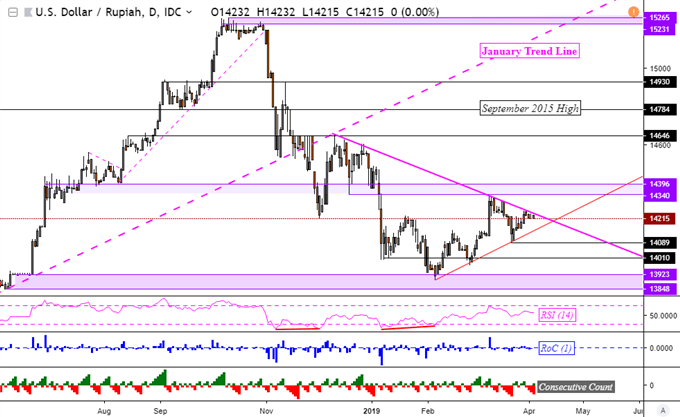

USD/IDR Technical Outlook: Neutral

As for the Indonesian Rupiah, the currency is wedged between a falling resistance line from December and a rising trend line from February. As such, USD/IDR may consolidate ahead. However, it is quickly running out of room in its oscillation. A breakout to the downside exposes support at 14089. On the flip side, rising entails facing a range of resistance between 14340 and 14396.

USD/IDR Daily Chart

**All Charts Created in TradingView

Read this week’s ASEAN fundamental outlook to learn about the underlying drivers for these currencies!

FX Trading Resources

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See how the US Dollar is viewed by the trading community at the DailyFX Sentiment Page

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter