EURUSD, DXY Technical Highlights

- EURUSD trading down into significant support

- DXY index nearing top of ascending wedge

- Volatility environment favors a fade here soon

For longer-term trading forecasts, educational material, and other helpful tools, check out the DailyFX Trading Guides page.

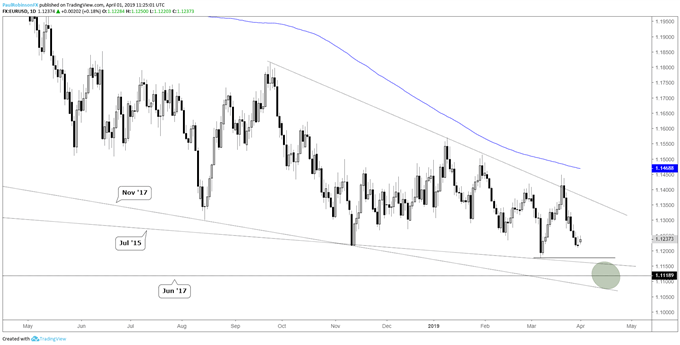

EURUSD trading down into significant support

The Euro trading lower the past week-and-a-half has brought back into play significant support, with a number of levels/lines running through the vicinity just beneath. A little lower lies the most recent low at 11176, the underside July 2015 and 2017 lines, followed by a minor swing level from June 2017.

With those levels in mind in the current low-volatility regime, risk will soon become skewed towards seeing another bounce develop as sustained moves have been absent for months. There is still some pips to go before the depths of the support range are probed, but keep an eye on how price action plays out here for signs of a low, or…

For momentum and volatility to pick up, it is likely needed that a break below the aforementioned support develops. If support breaks and momentum starts rolling, then the French election gap down to near 10700 will be at risk of filling.

EURUSD Daily Chart (Lots of support just below)

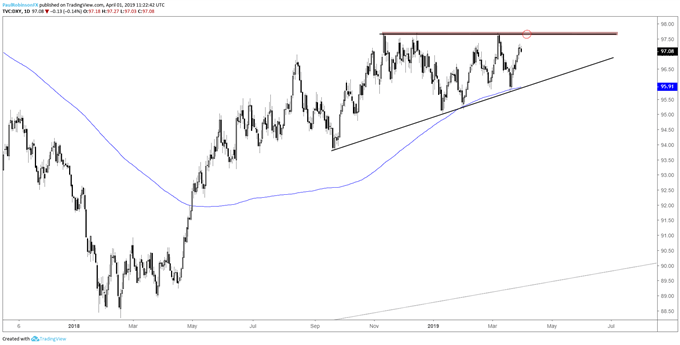

DXY index nearing top of ascending wedge

The Euro makes up the majority of the DXY index at a hefty 57% weighting. This means, so goes the Euro goes the USD index, in opposite direction of course. A EURUSD decline into support will likely have the DXY up against the top of an ascending wedge, with risk turning in favor of seeing a turn down develop and further along the wedge pattern.

In my view, it’s an ideal scenario that trading remains congested for a while longer so the pattern can mature even further. A tighter ascending wedge could bring significant power once a breakout develops. Months and months of pent up price action could lead to a much-desired breakout in FX volatility.

US Dollar Index (DXY) Daily Chart (resistance ahead, ascending wedge building…)

Forex & CFD Trader Resources

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX