US Dollar Technical Highlights

- Dollar to continue to trade higher in days ahead

- Levels and lines to watch in several pairs

- EURUSD, USDCAD, AUDUSD, NZDUSD in focus

For longer-term trading forecasts, educational material, and other helpful tools, check out the DailyFX Trading Guides page.

Dollar to continue to trade higher in days ahead

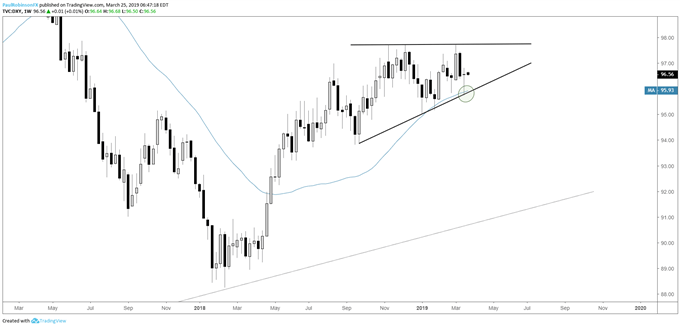

The US Dollar index (DXY) reversed last week after hitting confluent support by way of a trend-line and the 200-day MA. The underside trend-line remains a line of significant interest as it holds together the bottom of a developing ascending wedge.

The wedge may take a couple of months or longer to fully mature, but for now there appears to be a solid gradually rising floor in the Dollar. The reversal candle from last week suggests there will at least be an attempt to trade higher in the days ahead.

US Dollar Index (DXY) Weekly Chart (Ascending wedge developing)

US Dollar Index (DXY) Daily Chart (Well supported, room to trade higher)

EURUSD

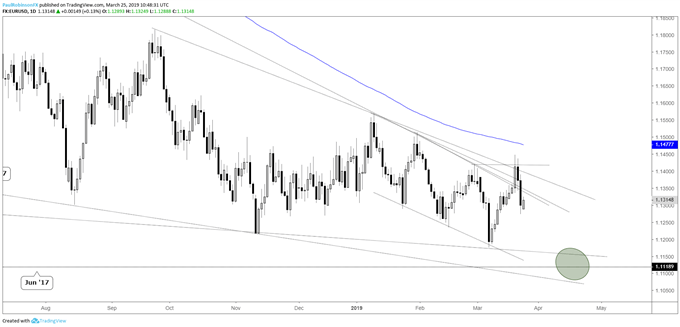

The Euro, accounting for ~57% of the DXY, is expected to be the main driver here for the DXY and with that in mind a small bounce is expected to fail. With further weakness after last week’s late turnaround it seems reasonable in this low volatility environment to expect a move down to the mid to lower 11100s, but perhaps nothing more until market participants show up in earnest.

EURUSD Daily Chart (lower t-line support eyed)

USDCAD

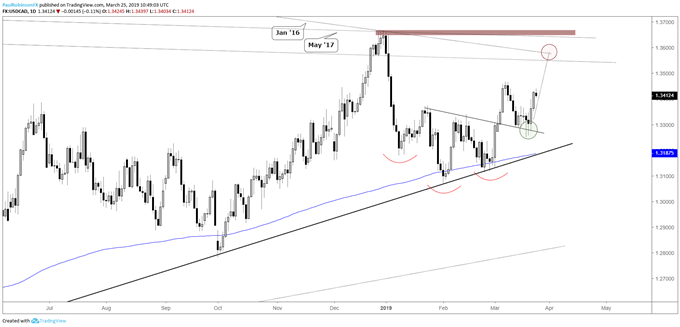

Last week, USDCAD tested neckline support and saw good sponsorship by posting a key-reversal on the 19th. The rally so far out of the low has held solid power, looking for this to continue to in the days ahead with 13467 as a minor hurdle in a run to the 13570s/3665-area at some point.

USDCAD Daily Chart (further follow-through on inverse H&S)

AUDUSD

Aussie reversed after running into trend resistance from January 2018. This kept price within the confines of a downward developing wedge. More weakness this week will would have the pattern filling out even more, and while AUDUSD has been weak it may signal a bigger reversal higher if upward momentum can sustain out of the descending pattern. The bias in the short-term and longer, though, remains generally towards lower prices until Aussie can prove otherwise.

AUDUSD Daily Chart (Descending wedge to develop more on drop)

NZDUSD

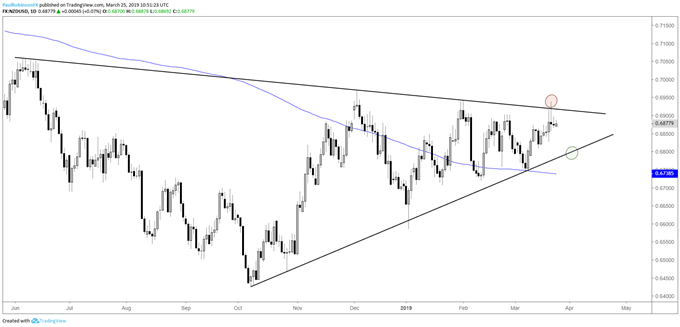

Kiwi has been a choppy mess for quite some time and this looks set to continue for a little while longer. Last week’s key reversal arrived right at the top-side trend-line of a developing big-picture wedge. The wedge is nearing the apex and due to break at any time. Once it does, look for a powerful move to ensue as pent up pressure built over months is set to release.

NZDUSD Daily Chart (Continue filling out big-picture wedge)

Forex & CFD Trader Resources

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX