To see what fundamentals may drive the next move in EUR/USD, check out the DailyFX Q1 Euro Forecast.

EUR/USD Volatility & Technical Highlights

- Euro volatility of volatility contracting

- Vol pattern suggests bigger price swings soon

- Follow the price action: 3 scenarios outlined

Euro volatility of volatility contracting

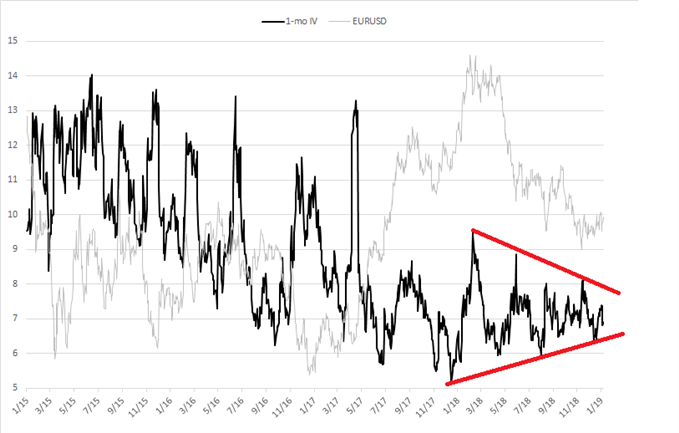

I often discuss triangle/wedge patterns due to their ability to forecast pending price movement, even if the breakout isn’t altogether clean coming out of the pattern. However, in this instance it isn’t the price of the Euro which has the cleanest contraction, rather its underlying volatility.

The volatility of volatility (vol of vol) has been declining since last January, and with 1-month vol quickly coming to an extreme point of quiet it on the verge of once again expanding. With this development lasting a year so far it suggests the uptick in Euro volatility should be material and lasting.

EUR/USD 1-Month Implied Volatility Chart (breakout coming...)

Data source: Bloomberg

Vol pattern suggests bigger price swings soon

With market conditions looking increasingly likely to become explosive, traders who have been banking on EUR/USD to stay range-bound may want to be on high alert for fade-trades to stop working. Those looking to trade momentum may soon be in business as conditions turn more favorable for breakout/momentum strategies.

Follow the price action: 3 scenarios outlined

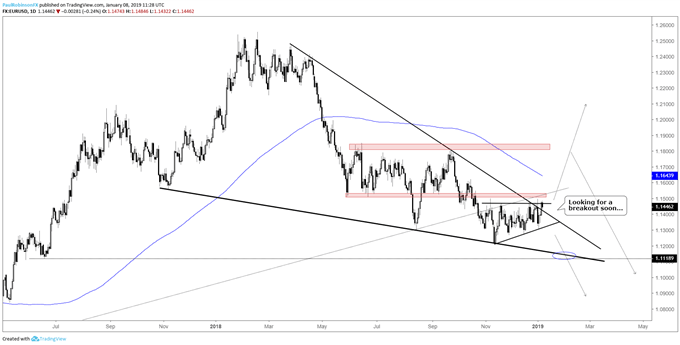

In addition to the range since late October, which could be firmly broken at any time, the price action since late last year, unsurprisingly, resembles the wedge in volatility. The key will be to follow the price action immediately presented but have the flexibility to adjust if need-be.

Here are a few scenarios to consider:

The first set-up is for the short-term range and descending wedge to break to the top-side towards 11800 and higher.

The second scenario is initially the same as the first but instead of a breakout leading to a sustained bullish trend, it turns into a truncated move which abruptly reverses (likely below or around the 11800-mark) with even swifter force than the initial rally.

The third scenario is for the recent range to break to the downside along with the underside trend-line from November; this would likely lead to a strong move lower in-line with the 1-year trend. This one could also reverse higher but seen as less likely.

Again, the key is flexibility and knowing that while all signs point to increased price swings, it may not initially be clear as to which one will be sustainable. But once price breaks free clarity should begin to present itself in a manner which gives traders an opportunity to latch onto expanding volatility.

Traders are short the Euro by a small amount, see how changes in positioning can act as a contrarian indicator on the IG Client Sentiment page.

EUR/USD Daily Chart (Follow the price action)

***Updates on this will be provided in trading/technical outlook webinars held on Tuesday and Friday. If you are looking for ideas and feedback on how to improve your overall approach to trading, join me on Thursday’s for the Becoming a Better Trader webinar series.

Resources for Forex & CFD Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX