As we look towards the opening quarter of 2019, focus will continue to fall on Brexit and until these risks dissipate, volatility may indeed persist. Brexit uncertainty keeps focus on that 1.2500 level, whereby a firm break below could see a new range of 1.2000-1.2500 throughout the quarter. And though restraint persists, the series of lower highs suggests momentum continues to hold Pound within its downward trajectory.

For Cable to see a move back towards 1.3000, a solution in the Brexit debacle will be needed. However, as it stands, this is not a path technical traders should simply presume.

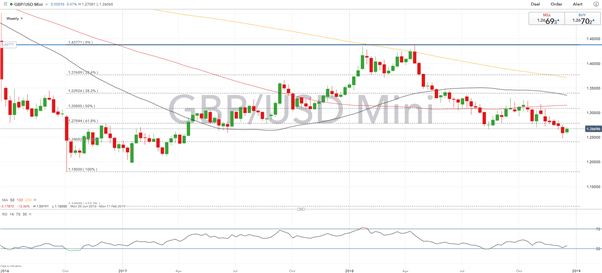

GBP/USD Price Chart: Weekly Time Frame (Feb 2016 – Dec 2018)

--- Written by Justin McQueen, Analyst