What’s inside:

- USDJPY one-week implied volatility rose overnight from near 7% to 8.65%

- Path of least resistance suggests lower prices could lie ahead

- One-standard deviation low and support from last year in confluence this time

Looking for a longer-term view on USDJPY? Check out our Q3 Forecast.

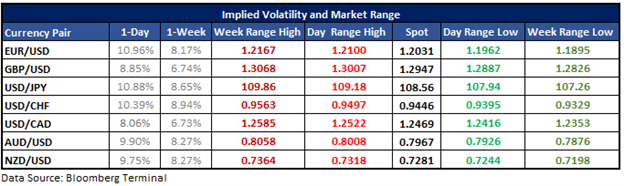

In the table below, we’ve listed levels of implied volatility (IV) for major USD-pairs for the next one-day and one-week time-frames. Using these levels, we’ve derived the range-low/high prices from the current spot price within one-standard deviation for specified periods. Statistically speaking, there is a 68% probability that price will remain within the lower and upper-bounds.

USDJPY implied volatility rises on North Korea threat, projected one-week range aligns with levels on both top and bottom-side, with a breakdown to be most probable way towards higher levels of IV

USDJPY is taking a hit with general risk-appetite on the back of North Korea firing a missile over Japan last night. One-week implied volatility has risen from just over 7% yesterday, to 8.65%, expanding the near-term range outlook. It points to a one-standard deviation range over the next week from spot price of 10726 to 10986. The low is of particular interest given the clear trend lower since USDJPY topped out on July 7, and increases the likely-hood we could see the lower threshold tested soon. There is support close at hand at 10813 (April low), but with volatility potentially to rise further we could see that level broken and lead to a peak set in July of last year. The 10749 high from over a year-ago and 10726 projected range-low are in close proximity. Risk is for that level to potentially fail should we see global equity markets and the ‘risk-trade’ as whole further weaken.

On the top-side, there is a trend-line running down off the July high and arrives well below the projected one-week high of 10986. If the pervasive downtrend is to maintain its integrity it is unlikely we will see USDJPY reverse back above the downward sloping resistance. If it does, though, the projected 10986 range-high may be difficult to exceed as there is solid price resistance right in the vicinity.

Overall, if volatility is to continue to rise it will come with further weakness in USDJPY. The lower projected level is at greater risk of breaking than the top-side given the current environment.

For other currency volatility-related articles please visit the Binaries page.

USDJPY: Daily

Join Paul on Thursday at 9:30 GMT time for a discussion on the most common trading mistakes and ways to correct them – SIGN UP HERE.

---Written by Paul Robinson, Market Analyst

You can receive Paul’s analysis directly via email by signing up here.

You can follow Paul on Twitter at @PaulRobinonFX.