What’s inside:

- USDJPY one-week implied volatility at 8.63% projects a 1 Stdev range of 1044-11106

- Both top and bottom-side projections in alignment with key support and resistance

- Look for both sides to hold with North Korea tensions simmering down

Looking for a longer-term view on USDJPY? Check out our Q3 Forecast.

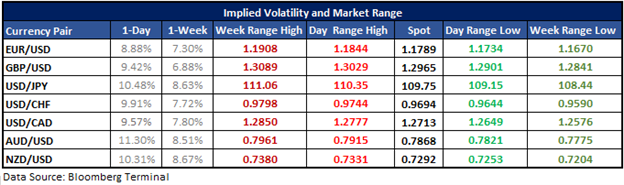

In the table displayed below, are implied volatility (IV) levels for major USD-pairs for the next one-day and one-week time periods. Using levels of IV we calculated the projected range-low/high prices from the current spot price within one-standard deviation for specified periods. (Statistically, there is a 68% probability that price will remain within the lower and upper-bounds.)

USDJPY projected low in near exact alignment with key price support, while the projected high lies around resistance within the context of a downtrend

Last week, when we took a look at USDJPY we said that the projected one-week low of 10916 should hold in a quiet summer trading environment given support in the vicinity from June. It hasn’t been a quiet last few days with the U.S./North Korean situation escalating and spurring volatility across the risk-spectrum, but nevertheless support held as the ‘risk-trade’ found support. On Friday, we saw USDJPY break through the June lows by about 10 pips before carving out a reversal-bar on the daily. So far with fear subsiding on North Korea tensions easing Europe is rallying and U.S. equity futures are in the green ahead of the U.S. open. This is helping USDJPY along. Overnight, Japan reported much better than expected preliminary 2Q GDP figures, but had limited impact on Yen traders.

Based on a current one-week implied volatility level of 8.63% the expected one-standard deviation range for the next week is 10844-11106. Looking lower, if Friday’s low fails the next area of support arrives at the April lows at 10813, with a closing worst at that time of 10843. The projected low of 10844 is in nearly precise alignment. Watch for support to hold should another dive lower take shape.

Looking higher USDJPY still has work to do to break the downtrend dating back to the 7/11 high. Should it find continued buying pressure a rebound unfolding towards the projected high of 11106 could stall. There lies resistance in the vicinity from a swing-high this month which lost momentum around prior support going back to the third week of June. This may be an area where sellers step in and keep USDJPY from furthering any attempt to rally in the near-term.

For other currency volatility-related articles please visit the Binaries page.

USDJPY: Daily

See the Webinar Calendar for a schedule of upcoming live events with DailyFX analysts.

---Written by Paul Robinson, Market Analyst

You can receive Paul’s analysis directly via email by signing up here.

You can follow Paul on Twitter at @PaulRobinonFX.