What’s inside:

- EURUSD one-day implied volatility suggests limited movement on FOMC, but leaves room for a surprise

- One-day one-standard deviation high arrives at yesterday’s reversal-day high

- Top-side one-week projection could be exceeded if yesterday’s key reversal is negated, lead to final thrust in euro, DXY into support

Looking for a longer-term view on EURUSD? Check out our Q3 Forecast.

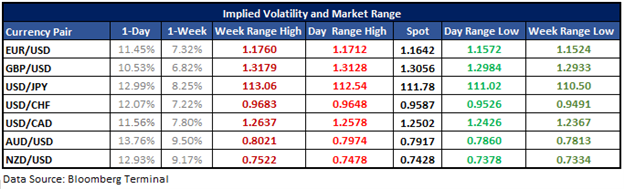

In the following table, you’ll find implied volatilities for major USD-pairs for one-day and one-week time-frames. Using levels of IV, we’ve calculated the projected range-low/high prices from the current spot price within one-standard deviation for specified periods. (Statistically speaking, 68% of the time price should remain within the lower and upper-bounds.)

EURUSD one-day implied volatility suggests limited movement on today’s FOMC announcement; be alert for a surprise.

Later today, at 18:00 GMT the Fed is expected to hold on interest rates, and on that the focus, barring a major surprise, will be on the policy statement and any significant signaling for the September meeting. Currently, as per Fed Fund futures, there is less than a 10% probability priced in for a hike at the next meeting, and a near 50/50 split on December. With the US dollar drowning and stocks continuing to forge on to new record levels, despite the Fed leaning on the hawkish side, markets across the board aren’t taking a September hike seriously. One-day implied volatilities are elevated heading into today’s outcome, but nothing significant. At 11.45%, EURUSD one-day is implying a 68% probability that price stays between 11572 and 11712. If the market has it right, then today will be a relatively non-event. However, if the Fed provides strong indications that another hike is in the cards in September then markets will be caught off guard and could quickly reprice assets accordingly.

Join Chief Strategist John Kicklighter live for the FOMC announcement, SIGN UP HERE.

The projected one-standard deviation high (68% probability of staying below) clocks in at 11712 from the current market price, which is precisely yesterday’s reversal-day high. Looking lower, the projected day-low comes in at 11572 and roughly aligns with the 7/18 day-high at 11583.

Looking beyond today, one-week implied volatility is priced relatively low at 7.32%, and suggests the euro is more likely than not to hold below 11760 and above 11524. EURUSD is extended and in an important area of resistance between the 2016 high and August 2015 high. This makes for an interesting spot to look for a reversal to take shape. Yesterday’s reversal-day could have been the beginning of a retracement if not possibly more. But if it doesn’t prove to be a worthy reversal then we could see the euro continue to surprise to the upside. If this is to be the case the one-week high could be at risk of becoming exceeded and the top-side parallel connected to the April trend-line may come into play over 11800 and the 2010 low at 11876. This would likely see the DXY down to the 92/93 zone where major long-term support lies and would offer a spot to look for the dollar to rebound and the euro to experience a material reversal.

For other currency volatility-related articles please visit the Binaries page.

EURUSD: Daily

See the Webinar Calendar for a schedule of upcoming live events with DailyFX analysts.

---Written by Paul Robinson, Market Analyst

You can receive Paul’s analysis directly via email by signing up here.

You can follow Paul on Twitter at @PaulRobinonFX.