What’s inside:

- USDJPY slow and steady towards major area of resistance

- One-week projected range-high towards upper end of resistance zone

- One-week range-low near lower end of

Looking for a longer-term view on USDJPY? Check out our Q3 Forecast.

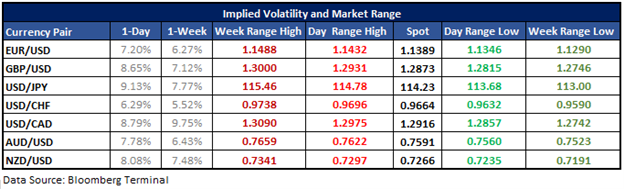

In the following table, you’ll find implied volatilities for major USD-pairs for one-day and one-week time-frames. Using these levels, we’ve calculated the projected range-low/high prices from the current spot price within one-standard deviation for specified periods. (Statistically speaking, 68% of the time price should remain within the lower and upper-bounds.)

USDJPY projected one-week high aligns with big resistance, one-week low with minor short-term support

Since the middle of last month, the rally in USDJPY has been slow and steady. The first test of resistance is upon us, with the pair trading near the May high at 11467. A breach of this key level will expose an even more important area of resistance in the vicinity of 11485/11562; an area USDJPY turned lower from on several occasions from January to March. The projected one-standard deviation one-week high is at 11546, right near the upper portion of the resistance zone. On first approach, there may be difficultly in overcoming this area in the short-term. If buyers are able to push it through 11562, USDJPY will quickly face another key test of resistance by way of the trend-line extending down off the June 2015 high. The trend-line was a significant factor in January and could very well be highly influential once again. With that in mind, even though a push through price resistance may develop it may not be sustainable.

Looking to the one-week projected low, it falls at 11300. This lines up around the lower end of a small consolidation period created last week prior to Friday’s rally. Giving the near-term trend the benefit of the doubt it’s a spot to watch for price action to show buying interest.

The big risk event of the week will be the Fed Chairwoman, Janet Yellen, testifying in Washington on Wednesday and Thursday. For details, see the economic calendar.

For other currency volatility-related articles please visit the Binaries page.

USDJPY: Daily

See the Webinar Calendar for a schedule of upcoming live events with DailyFX analysts.

---Written by Paul Robinson, Market Analyst

You can receive Paul’s analysis directly via email by signing up here.

You can follow Paul on Twitter at @PaulRobinonFX.