What’s inside:

- EURUSD pulls back from confluence of resistance, but supported

- One-week projected range suggests top-side at greater risk of breaking than down-side

- Range-low is in nearly perfect alignment with the 200-day MA, price support zone

Which direction will EURUSD move in Q3? Check out our forecasts!

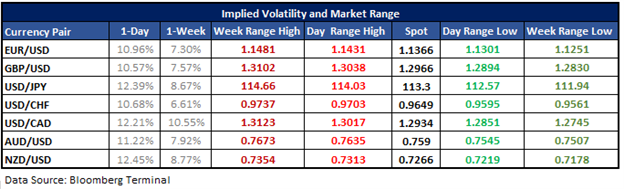

In the table below, you’ll find implied volatilities for major USD-pairs for the next one-day and one-week time-frames. Using these levels, we’ve calculated the range-low/high prices from the current spot price within one-standard deviation for specified periods. (Theoretically speaking, 68% of the time price should remain within the lower and upper-bounds.)

EURUSD turned lower from key area of resistance, but risk remains skewed to the top-side with the one-week projected range-high at higher risk than the range-low

Last week – EURUSD – after running sharply higher from a pullback ran into resistance by way of a trend-line extending lower from the August 2015 peak over the 2016 high. In this vicinity also lies several swing highs as far back as early 2015, with the most recent turning points coming during the first-half of 2016. The confluence of swing-highs and long-term trend-line make the mid-11400s an important inflection point, and a formidable area for buyers to push the single-currency through.

Looking at one-week implied volatility (currently at 7.3%), the projected one-standard deviation projected high clocks in at 11481, which is 36 pips above last week’s top. It suggests we may see a move beyond the beforementioned resistance and depending on momentum at the time it could turn out to be a meaningful breakout which could expose the 2016 high at 11615.

Looking lower, the projected one-week low is at 11251, which falls just below solid horizontal and trend-line support. Giving the benefit of the doubt to the strength of the trend and support the lower-bound looks less likely to be breached looking out over the next week. A decline to the 11300/285 area may present an attractive spot for would-be longs to enter. If, however, we see a close below the trend-line and support then a move back towards 11100 (200-day MA at 11446) may be in the works. A daily closing bar below support would be our cue that the lower range threshold may be underpriced and selling could become aggressive.

The thinking on this end is that we will see the euro digest the recent swing higher and remain supported for the foreseeable future, with risk skewed towards seeing the projected range-high at more of a risk of breaking that the range-low.

Volatility heads up: Tomorrow at 12:30 GMT is the release of the U.S. jobs report. The consensus estimate is for the economy to have added 177k jobs during June. For details, see the economic calendar.

For other currency volatility-related articles please visit the Binaries page.

EURUSD: Daily

See the Webinar Calendar for a schedule of upcoming live events with DailyFX analysts.

---Written by Paul Robinson, Market Analyst

You can receive Paul’s analysis directly via email by signing up here.

You can follow Paul on Twitter at @PaulRobinonFX.