US Dollar Technical Forecast: Neutral

- The US Dollar put in a strong move this week but next week brings the FOMC and this has the potential to shape trends for the weeks or even months ahead.

- So far in 2021 the USD has been mean-reverting. But with prices pushing up for a resistance test, the potential for fresh highs is there but will likely need some help from the Federal Reserve at next week’s rate decision. For setups on either side of the US Dollar, check out the earlier-posted Analyst Pick.

The analysis contained in article relies on price action and chart formations. To learn more about price action or chart patterns, check out our DailyFX Education section.

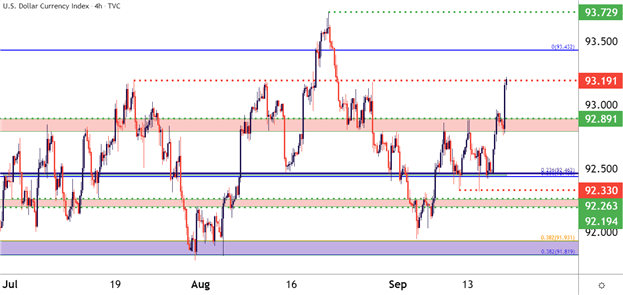

In the week before the September FOMC rate decision, the US Dollar put in a strong move-higher, but much of that was relegated to Thursday and Friday trade. On Wednesday prices in DXY were testing range support, plotted around a couple of Fibonacci levels in the 92.46 area on the chart. But it was a really strong retail sales report that seemed to shake things loose, as markets were looking for a contraction of -.8% and instead got a gain of .7%. That brought a quick rush of strength into the USD, pushing the currency up to what had been range resistance before buyers began to grind the move-higher.

On Friday, University of Michigan Consumer Sentiment numbers were released and this came in below expectations; but that seemed to matter little as USD bulls posed another topside breakout, pushing prices to the 93.19 resistance level and beyond, helping to set a fresh September high for the USD.

The next major points of resistance on the chart are big ones, plotted at 93.43, which is the Q1 swing high, and at 93.73, which is the 2021 swing high in the US Dollar.

US Dollar Daily Price Chart

Chart prepared by James Stanley; USD, DXY on Tradingview

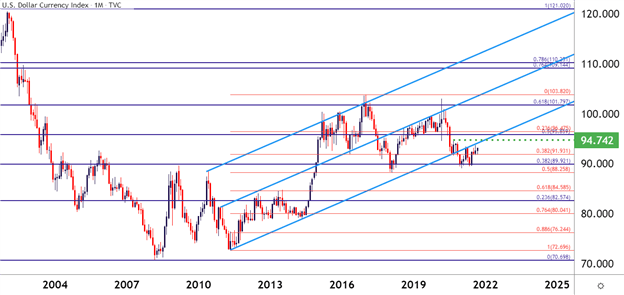

Taking a step back on the chart and the importance of the current resistance zone becomes a bit more clear, and this also highlights how a breakout beyond 93.73 may have to content with another series of levels, plotted around 94.30 (Dec, 2020 swing high) and 94.74 (Sept, 2020 swing high). Those are all big decision points but if USD bulls can budge through this zone, the bullish move will look much more decisive. Until then, bulls should look to exercise caution, particularly with short-term price action as the move feels rather stretched at this point.

US Dollar Weekly Price Chart

Chart prepared by James Stanley; USD, DXY on Tradingview

US Dollar Strategy for Next Week

For next week – a pullback to support around prior short-term resistance, around that 92.80-92.90 zone, can keep the door open for bullish continuation approaches going into FOMC.

For FOMC, however, the range of possible outcomes is massively wide; and while this can normally be the case around a quarterly FOMC rate decision, the fact that we have taper up for discussion and that the Fed has previously said they thought it’d be appropriate to start this year, makes next week even that much more unusual.

The forecast for next week will be set to neutral simply due to the uncertainty around the Wednesday rate decision; but there’s potential on either side of the matter. A pullback to support can keep the door open for bulls going into the rate decision. A bullish breakout after FOMC can keep that door open; while a breach of support after the FOMC can start to open the door for bears again.

--- Written by James Stanley, Senior Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX