USD/CAD WEEKLY FORECAST: SLIGHTLY BULLISH

- USD/CAD has bounced off support and could move higher in the week ahead

- Risk aversion and safe-haven demand linked to concerns over rising Covid-19 cases could reinforce the rebound in the US dollar, weighing on the Canadian dollar

- In this article we present the most relevant technical levels for USD/CAD.

Most read: USD/CAD Breaches 1.2500. What could happen next?

The USD/CAD rally that started in early June and took the price to a 5-month high of 1.2807 on July 19 has started to unravel of late, especially after this week's FOMC monetary policy announcement. At this week's conclave, the central bank left both its benchmark interest rate and asset purchase program unchanged, but noted that the U.S. economy has made some progress toward the standards needed to begin withdrawing stimulus.

Nevertheless, the Fed's message did not boost the greenback, as the FOMC chairman was quick to point out that progress is not yet significant enough to warrant a change in policy. These comments led many traders to conclude that any "tapering announcement" will come not in the next couple of months, but toward the end of the year, a scenario that may keep Treasury yields depressed for now in the United States.

All else equal, the dovishposture embraced by the Fed can be seen as a bearish catalyst for the U.S. dollar in the medium term; however, in the very short term, there are other more important issues for the currency market that may relegate monetary policy to a secondary role.

Coronavirus has become once again the main preoccupation in traders’ minds. Recently, several countries such as Australia, Japan and the Philippines have re-imposed new lockdowns to curb the spread of COVID-19.Investors believe that with the more transmissible delta variant raging in the US and other regions, it is only a matter of time before we see governments implement aggressive containment measures, especially where vaccination levels remain low. In the very near future, the threat of further lockdowns or other restrictive measures will likely dent risk appetite and dampen the prices of some commodities, such as oil, boosting the attractiveness of safe-haven currencies. This situation could bias USD/CAD higher in the coming week.

USD/CAD TECHNICAL ANALYSIS

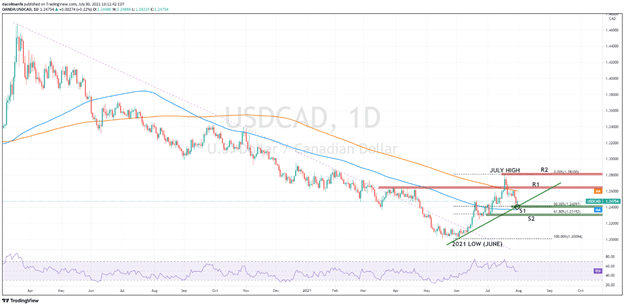

Following the Fed-induced sell-off, USD/CAD appears to have found support in the 1.2420 area, where a short-term rising trendline aligns with the 50% retracement of the June/July rally. If the FX pair manages to stay above this region in the next few days, buyers could gain the upper hand and push prices towards resistance near the 1.2600/1.2650 zone. A close above this technical barrier could pave the way for a move towards the July high (1.2807).

On the flip side, if USD/CAD sinks below 1.2420 decisively, selling pressure could strengthen and drive the exchange rate towards the next floor at 1.2320 (61.8% Fib retracement). The near-term bearish case for the U.S. dollar, however, seems less likely as risk-aversion and haven demand could dominate market moves next week.

| Change in | Longs | Shorts | OI |

| Daily | -2% | 7% | 5% |

| Weekly | -30% | 38% | 13% |

USD/CAD TECHNICAL CHART

Source: TradingView

EDUCATION TOOLS FOR TRADERS

- Are you just getting started? Download our beginners’ guide for FX traders

- Would you like to know more about your trading personality? Take our quiz and find out

- IG's client positioning data provides valuable information on market sentiment. Get your free guide on how to use this powerful trading indicator here.

- Subscribe to the DailyFX Newsletter for weekly market updates and insightful analysis

---Written by Diego Colman, DailyFX Market Strategist