US Dollar Talking Points:

- The below is taken from the DailyFX Q3 Forecasts, with this article looking at the technical side of the US Dollar.

- The fundamental forecast for the US Dollar was authored by Chief Strategist, John Kicklighter.

- To read the full US Dollar forecast including the technical outlook, download our new 3Q trading guide from the DailyFX Free Trading Guides, which can be accessed from the below link:

I had set the technical forecast for the Greenback as bearish last quarter, looking for the same trend that drove from the last nine months of 2020 trade to continue in similar effect. And, for the first seven weeks of Q2, that’s what happened: The US Dollar set a top on the final trading day of Q1, and sellers drove the currency right back down to the same huge spot of support that held the lows in Q1. This is a confluent zone of support around the 90.00 handle on DXY, and when it first showed up in January, it helped to produce a reversal so the big question was whether a second test a few months later would have the same effect, and so far it has.

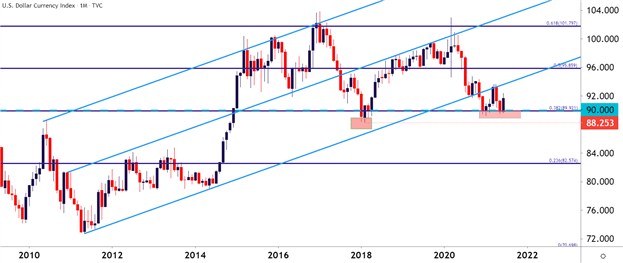

The monthly chart below is the same that was shared in the prior two quarterly forecasts for the US Dollar, and there’s a few elements of note. The Fibonacci retracement spans from the 2001 high to the 2008 low, a major move from which neither the high or low has been tested. The trend channel originated in 2010/2011 and, until Q4 of last year, had guided US Dollar price action for almost a decade until sellers were able to elicit a bearish breach last November. The underside of that channel is what’s currently helping to set the seven-month-high in the currency, as this was the price that came into play on that final trading day of Q1.

The key part to focus on, however, is that confluent support zone that’s now reversed two bearish US Dollar trends so far in 2021 trade.

US Dollar Monthly Price Chart

Chart prepared by James Stanley; USD, DXY on Tradingview

US Dollar Trend Remains Bearish, but May Need Some Time

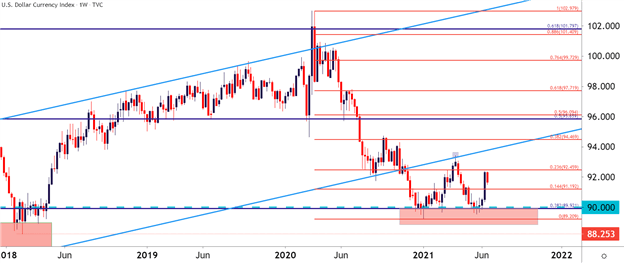

That confluent support zone around the 90 handle on DXY has proven to be a tough spot on the chart for bears to break through. It wasn’t without trying, however, as sellers spent five consecutive weeks trying to push through the 90 level, only to be continually rebuked ahead of the June FOMC rate decision. But, notably, we did not see a weekly close below the 90 handle in Q2 and prices put in a higher-low, refusing to test the 89.20 swing-low that had come into play in the first week of the year. So, combining these two observations and it seems as though the USD is still harboring some oversold tendencies from that heavy trend that priced-in for the bulk of last year.

US Dollar Weekly Price Chart

Chart prepared by James Stanley; USD, DXY on Tradingview

US Dollar Technical Forecast for Q3: Neutral

So, at this point, sellers have controlled the big-picture trend in the USD for over a year but, failed to test the low in Q2, instead getting caught in a big area of confluent support.

This may simply mean that the trend is awaiting another driver and, at this point, it looks like bears may have to wait for some time before that driver avails itself. The Jackson Hole meeting later in the summer or perhaps the September FOMC rate decision may provide such motive but, at this point and judging by how the Fed has navigated so far, those events may be more prone to hawkish commentary or discussion about tapering, neither of which would appear to help US Dollar bears.

The above logic spells out rationale for avoiding a bearish technical bias on the US Dollar for Q3, essentially in the effort of being patient. But what about the long side? That, too, can be complicated as it appears unlikely that we’ll see any affirmative information towards higher rates. We may hear more about tapering at Jackson Hole or perhaps the September rate decision but, if what the Fed is saying turns out to be correct, that inflation is, in fact, transitory, well then there might not be as much demand for normalization or tapering of asset purchases as what we had seen in Q1 or Q2.

The technical forecast for the US Dollar for Q3 will be set to neutral, owed to the conflicting nature of both the drivers and 2021 trends that have shown in the currency thus far.

--- Written by James Stanley, Senior Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX