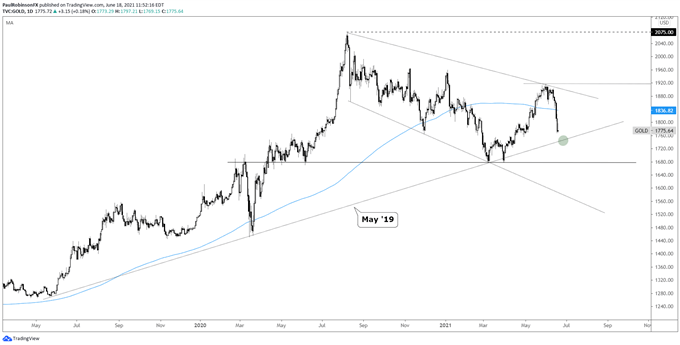

Gold Price Technical Outlook:

- Gold’s big losses last week took market by surprise

- 2019 trend-line to come into play soon

Gold Price Forecast – Big Down Week Has XAU Nearing Trend Test

Last week gold was crushed, with it having one of its worst weeks since Coronavirus hit last year. The downdraft has important longer-term trend support in view. There lies not far below a trend-line from May 2019.

With the trend-line around the 1745 mark, give or take a few handles, it is very likely to get tested here shortly. Initially, it will be respected as support. The thinking is that at the very least it will impede downward momentum even if support is to eventually break.

With that in mind, from a tactical standpoint there are some considerations to have depending on the stance. If already short from higher prices, then looking to this as a potential profit objective, and or as a spot to initiate some sort of trailing stop strategy makes sense.

From the perspective of entering fresh shorts, at the swing level (a few days to weeks), the risk/reward isn’t particularly appealing with significant support not too far away. Waiting for further cues appears to be a prudent approach. Very short-term minded traders (<1 day) may want to continue playing the downward momentum.

For would-be longs, the trend-line could offer up a line-in-the-sand from which to initiate a good/reward entry. It may be preferred to wait and see if price reacts sharply off the trend-line first, but different entry tactics can be used.

A decline below the trend-line will be reason for the downward bias to intensive towards strong support around 1676. This will keep shorts in the game for a bit longer before another important level to watch comes into play.

Gold Price Daily Chart

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX