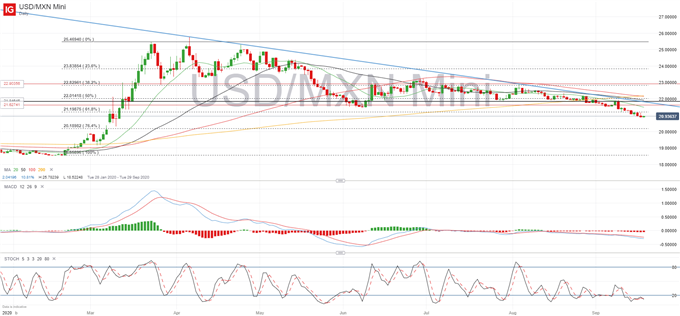

USD/MXN Technical Forecast: Bearish

After another week of continued declines, USD/MXN gears up to start the new week with further downside pressures, with the Banxico interest rate decision in focus on Thursday.

Since the beginning of August, USD/MXN has sustained a downside trajectory as it has given in to bearish pressures. But as a proxy for worldwide risk appetite, the pair has remained volatile since it started the greater downside move back at the end of March. Risk appetite has recovered significantly since the end of July, which has led to a decline in the attractiveness in the Dollar and therefore a lack of buyer support for USD/MXN.

USD/MXN daily chart (28 January – 18 September 2020)

The break below 21.00 means the previous support at the 61.8% Fibonacci retracement from the 18.55 – 25.46 surge has now turned resistance, capping upside momentum at 21.19. The alignment of the moving averages points to continued selling pressure, as the 100-day simple moving average has slipped below the 200-day, which means they now progress from largest to smallest when counting downwards. Further selling pressure is expected to attract more buyers for the Peso, as they attempt to close the coronavirus gap seen in USD/MXN between 20.50 and 20.38. Negative bias will remain as long as the pair remains below the trendline originated in Aril, now offering resistance at 21.85.

At this point, the pair continues to be dominated by general market sentiment, although renewed weakness in equity markets doesn’t seem to have put that much of a dent in the peso’s path. Interestingly, this Thursday will see Banxico’s latest interest rate decision, where analysts are predicting rates to remain unchanged at 4.5%. In three of the last four interest rate decisions USD/MXN ended the day lower, although in all of those cases the interest rate was reduced by 50 basis points, which could be different this time if analysts’ predictions are correct.

USD/MXN performance based on Banxico meetings (October 2019 – September 2020)

--- Written by Daniela Sabin Hathorn, Market Analyst

Follow Daniela on Twitter @HathornSabin