Japanese Yen Talking Points

The technical outlook for USD/JPY highlights the potential for a broad based recovery in the Japanese Yen as both price and the Relative Strength Index (RSI) snap the upward trends from earlier this year, but the exchange rate may stage a larger recovery going into July as it reverses ahead of the May low (105.99).

Technical Forecast for Japanese Yen: Neutral

USD/JPY is little changed in June following the pullback from the monthly high (109.85), and the Dollar Yen exchange rate appears to be moving to the beat of its own drum as it consolidates within the broad price range from March.

In fact, the Japanese Yen continued to deprecate against the commodity bloc currencies in June as AUD/JPY traded to a fresh yearly high (76.79), but it remains to be seen if the bullish behavior will persist as the Reserve Bank of Australia (RBA) starts to jawbone the local currency, with the exchange rate holding a narrow range following the interest rate decision.

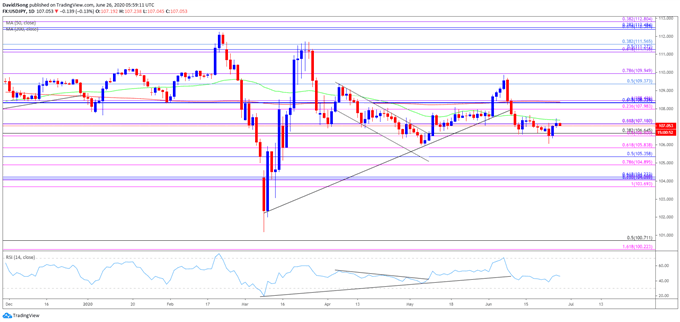

With that said, the technical outlook for USD/JPY also highlights the potential for a broad based recovery in the Japanese Yen as both price and the Relative Strength Index (RSI) fail to preserve the bullish trends carried over from March. The developments undermine the recent rebound in the Dollar Yen exchange rate as the RSI fails to push back above 50, with the reaction signaling a potential exhaustion in the advance from the monthly low (106.07).

However, the 200-Day SMA (108.37) suggests the broad price range from March will remain intact going into the second half of the year as the simple moving average continues to carve a flat slope.

In turn, USD/JPY may trade within a more defined range asthe pullback from the monthly high (109.85) reverses ahead of the May low (105.99), and the RSI may indicate a further appreciation in the exchange rate if the oscillator breaks above 50 and climbs towards overbought territory.

USD/JPY Rate Daily Chart

Source: Trading View

USD/JPY appears to have marked another failed attempt to test the 105.80 (61.8% expansion) region as it reverses ahead of theMay low (105.99), and the exchange rate may continue to retrace the decline from earlier this month as it attempts to push back above the 50-Day SMA (107.37).

As a result, the close above 107.20 (61.8% retracement) brings the Fibonacci overlap around 108.00 (23.6% expansion) to 108.40 (50% retracement) on the radar, with the next area of interest coming in around 109.40 (50% retracement) to 110.00 (78.6% expansion), which lines up with the June high (109.85).

A break of the June high (109.85) opens up the overlap around 111.10 (61.8% expansion) to 111.60 (38.2% retracement), which largely coincides with the March high (111.72), but it remains to be seen if USD/JPY will stage a larger recovery over the coming days as the RSI struggles to push back above 50.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong