Australian Dollar Talking Points

AUD/USD fills the gap from the start of the week even though Reserve Bank of Australia (RBA) Governor Philip Lowe jawbones the Australian Dollar, but recent developments in the Relative Strength Index (RSI) warn of a larger correction in the exchange rate as the indicator falls back from overbought territory and snaps the upward trend from earlier this year.

AUD/USD Rate Rebounds Even as RBA Jawbones Australian Dollar

AUD/USDattempts to retrace the decline following Australia’s Employment report, which showed the economy shedding 227.7K jobs in May, and the exchange rate may face range bound conditions going through the last full week of June as it bounces back ahead of last week’s low (0.6777).

It remains to be seen if the ongoing weakness in the labor market will sway the monetary policy outlook as the Reserve Bank of Australia (RBA) Minutes reveal that the “Bank had purchased government bonds on only one occasion since the previous meeting,” and the central bank may continue to tame speculation for additional monetary support as “members agreed that the Bank's policy package was working broadly as expected.”

In turn, the RBA may stick to the sidelines at the next interest rate decision on July 7 as officials vow to “not increase the cash rate target until progress is made towards full employment,” but it seems as though the recovery in AUD/USD has caught the central bank’s attention as Governor Lowe insists that a lower Australian Dollar would help to lift inflation.

Looking ahead, a growing number of RBA officials may attempt to jawbone the local currency as renewed cases of COVID-19 in China, Australia’s largest trading partner, dampens the scope for a V-shape recovery, and the central bank may come under pressure to further support the economy as stimulus programs like the Jobkeeper Paymentis set to expire on September 27.

As a result, RBA board member Ian Harper argues that fiscal authorities should set up a “tapering arrangement,” but the government of extending the stimulus programs as Standard and Poor’s and Fitch Ratings cut Australia’s credit rating outlook to ‘negative’ from ‘stable.’

With that said, AUD/USD is likely to face headwinds if the RBA shows a greater willingness to implement more non-standard measures in 2020, but recent developments in the Relative Strength Index (RSI) warn of a potential shift inmarket behavior as the indicator falls back from overbought territory and snaps the upward trend from earlier this year.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

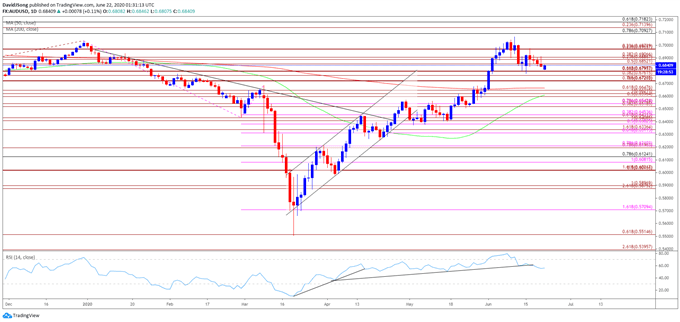

AUD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the monthly opening range was a key dynamic for AUD/USD in the fourth quarter of 2019 as the exchange rate carved a major low on October 2, with the high for November occurring during the first full week of the month, while the low for December materialized on the first day of the month.

- The opening range for 2020 showed a similar scenario as AUD/USD marked the high of the month on January 2, with the exchange rate carving the February high during the first week of the month.

- However, the opening range for March was less relevant, with the high of the month occurring on the 9th, the same day as the flash crash.

- Nevertheless, the advance from the yearly low (0.5506) gathered pace as AUD/USD broke out of the April range, with the exchange rate clearing the February high (0.6774) as the Relative Strength Index (RSI) pushed into overbought territory.

- Recent price action warns of a near-term correction in AUD/USD as the advance from earlier this month fails to produce a test of the July 2019 high (0.7082), with the RSI highlighting a similar dynamic as the oscillator pushes below 70 and snaps the bullish formation from earlier this year.

- Nevertheless, AUD/USD may face range bound conditions during the last full week of June as the exchange rate bounces back ahead of last week’s low (0.6777), with the failed attempt to break/close below the 0.6720 (78.6% expansion) to 0.6800 (61.8% expansion) region bringing the 0.6970 (23.6% expansion) to 0.6980 (23.6% expansion) region on the radar as it lines up with last week’s high (0.6977).

- Need a break/close below Fibonacci overlap around 0.6970 (23.6% expansion) to 0.6980 (23.6% expansion) to open the downside targets, with the first area of interest coming in around 0.6600 (50% expansion) to 0.6650 (61.8% expansion) followed by the 0.6520 (38.2% expansion) 0.6540 (78.6% expansion) region.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong