Crude Oil Highlights:

- WTI crude oil rallying hard, but has obstacles in the way

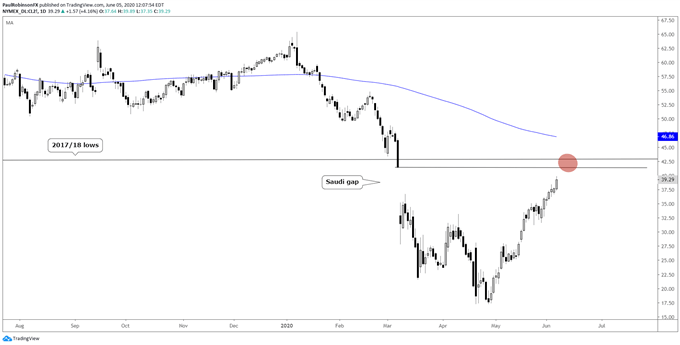

- Saudi gap and 2017/18 lows are in near confluence

WTI Crude oil rallying hard, but has obstacles in the way

WTI crude oil has been pretty much on a one-way path since bottoming in late April, but the path could get bumpier soon as confluent resistance stands in the way of the advance over the 40-mark. Oil is currently trading inside the March 9 Saudi gap that shook financial markets when they were already reeling from the coronavirus.

The gap is a rather significant hole that leaves a little more room to go before it is filled up to 41.51. Not too far beyond that point is the June 2017 and December 2018 lows that are in almost exact alignment at 42.27/42.67, respectively. It appears likely there will be some kind of fight that develops around the 41.51/42.67 zone. It could come as quick as this week, but perhaps it takes a little longer if oil slows its roll until reaching for resistance.

From a tactical standpoint, fresh longs don’t appear to hold good risk/reward while shorts are still risky with oil trending higher and no significant resistance yet at hand. That could soon change, where existing longs are at risk of a decline developing, while shorts gain the upper hand off of resistance.

Crude Oil (Aug Contract) Daily Chart (confluent resistance ahead)

Crude Oil Chart by TradingView

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX