US Dollar Technical Forecast

- US Dollar weakness persisted, but strong gains on Friday overturned breakouts

- EUR/USD, GBP/USD, AUD/USD and NZD/USD struggled around trend lines

- Large wicks showed signs of indecision in investors, will reversals follow next?

US DollarWeek Ahead

This past week was not a pretty one for the US Dollar, but it could have been worse. It continued depreciating on average against its major counterparts on fundamental themes such as trade wars and the UK General Election. It did push out a comeback on Friday, leaving behind fairly large wicks and signals of indecision. What does the week ahead entail from a pure technical standpoint?

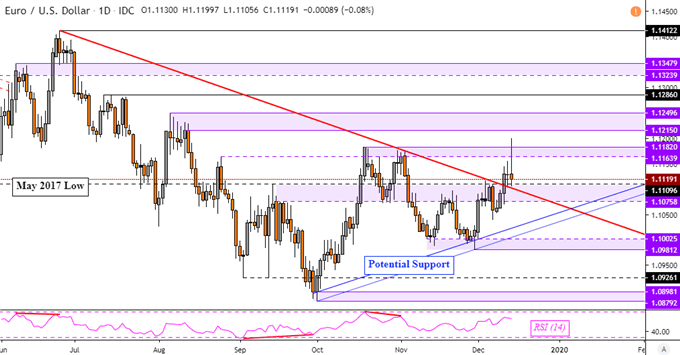

EUR/USD Technical Outlook

EUR/USD managed an important technical breakout, pushing above a key falling trend line from June. It was also on pace to breach the next psychological barrier which is a range between 1.1163 and 1.1182. Yet, sellers managed to come back into play, leaving behind a large shadow. That has both reinforced resistance and undermined the breakout through the descending line. Immediate support is a boundary between 1.1109 and 1.1075 which if taken out, puts the dominant downtrend back in focus.

EUR/USD Daily Chart

EUR/USD Chart Created in TradingView

GBP/USD Technical Outlook

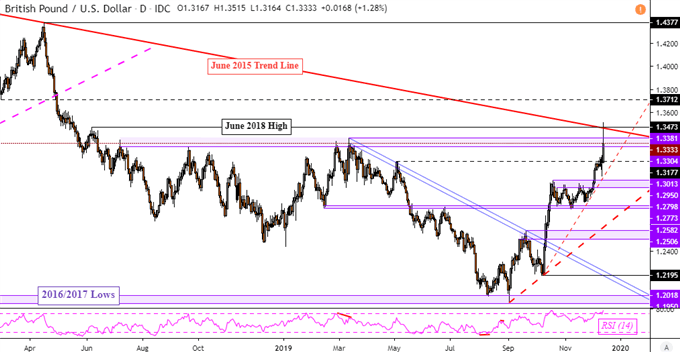

The British Pound also struggled to confirm breakouts above key technical barriers. These are a combination of the falling trend line from June 2015 and 1.3473. Instead, prices got caught within the psychological barrier between 1.3304 and 1.3381. That has reinforced resistance which may keep bulls at bay in the week ahead. Immediate support sits below at 1.3177 before the familiar range between 1.3013 and 1.2950. If the British Pound manages to overcome resistance on the other hand, that would expose 1.3712 which is the former low from March 2018.

GBP/USD Daily Chart

GBP/USD Chart Created in TradingView

AUD/USDTechnical Outlook

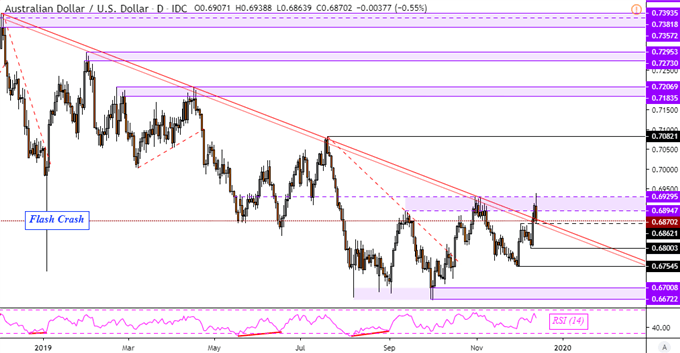

A similar story unfolded in the Australian Dollar after AUD/USD closed above key falling resistance from December 2018. The horizontal range between 0.6894 and 0.6929 held as prices turned lower on Friday and stopped short of support at 0.6862. That has undermined that technical breakout and reinforced resistance. Taking out the former would pave the way for uptrend resumption towards July highs. Otherwise, prices may turn lower from here towards 0.6800 and 0.6754.

For timely updates on US Dollar price action, you may follow me on Twitter here @ddubrovskyFX

AUD/USD Daily Chart

AUD/USD Chart Created in TradingView

NZD/USD Technical Outlook

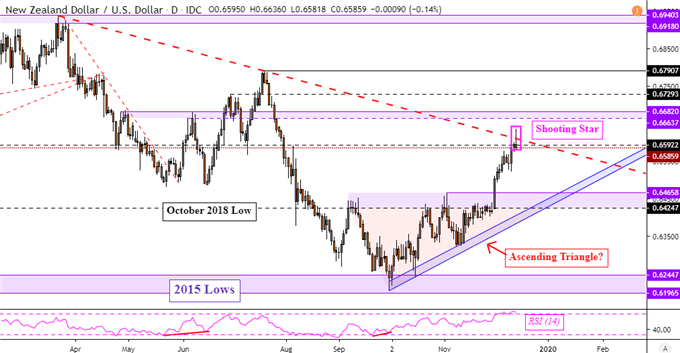

This is as the New Zealand Dollar left behind a Shooting Star candlestick against the US Dollar, which is a sign of indecision. NZD/USD also failed to push above a descending trend line from March. Cautious weakness may confirm the candlestick pattern and pave the way for a reversal of the near-term uptrend from October. That may send prices towards the ceiling of the Ascending Triangle (0.6424 – 0.6465) now that its breakout has played out. Otherwise, resuming gains puts the focus on highs from July.

NZD/USD Daily Chart

NZD/USD Chart Created in TradingView

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter