Euro Technical Forecast Talking Points

- Euro made cautious upside progress against its counterparts this past week

- EUR/USD shows most potential for follow-through, EUR/JPY eyes Sep. line

- EUR/GBP falling towards current 2019 lows, EUR/AUD stalls at resistance

Trade all the major global economic data live as it populates in the economic calendar and follow the live coverage for key events listed in the DailyFX Webinars. We’d love to have you along.

EUR/USD Chart Outlook

The Euro pulled off a cautious recovery against the US Dollar towards the end of last week, potentially setting itself up for a near-term reversal. EUR/USD has left behind a Morning Star which is a bullish candlestick pattern that has also seen upside confirmation. But, the dominant downtrend may be kept intact by a combination of the October highs (1.1164 – 1.1182) and a potential falling trend line from June. Resuming the downtrend entails a close under 1.0989.

For timely updates on the Euro technical outlook, follow me on Twitter here @ddubrovskyFX

EUR/USD Daily Chart

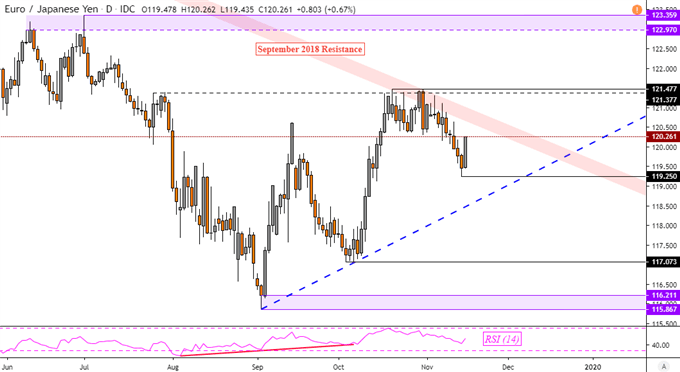

EUR/JPYChart Outlook

Against the Japanese Yen, the Euro climbed on Friday as EUR/JPY left behind near-term support at 119.25. The dominant downtrend may be kept intact by a descending channel of resistance going back to September 2018. If this psychological barrier holds and resumes selling pressure, the pair may find itself struggling to close under what could be a potential rising support line from September. This could then translate into consolidation. Downside momentum may be the case ahead given the bearish outlook in trader positioning.

Join me every week on Wednesday’s at 01:00 GMT to learn how to use market positioning as another tool in your trading strategy !

EUR/JPY Daily Chart

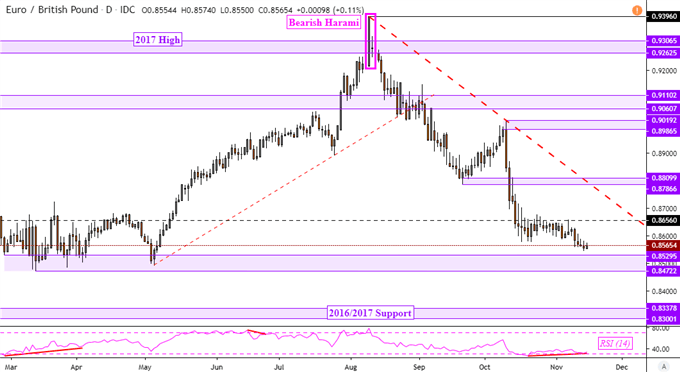

EUR/GBPChart Outlook

The British Pound continues to make slow progress against the Euro since the EUR/GBP downtrend ensued back in August. Prices are approaching the key psychological barrier established earlier this year as a range between 0.8472 and 0.8530. Positive RSI divergence does however show fading downside momentum. At times, this can translate into an upside push towards key resistance at 0.8656. Beyond that lays a potential falling trend line from August that may keep the dominant downtrend intact.

EUR/GBP Daily Chart

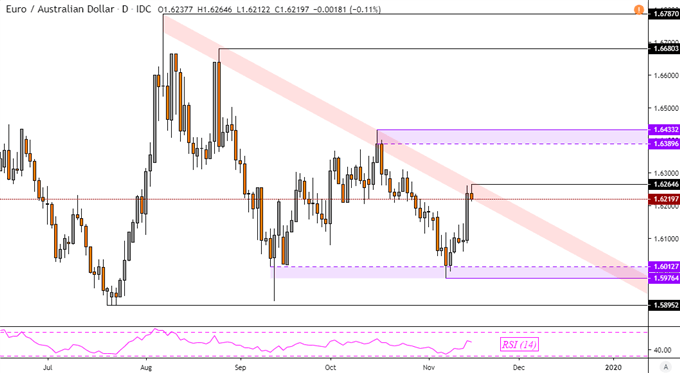

EUR/AUDChart Outlook

Gains in the Euro, including against the Australian Dollar, has brought EUR/AUD into a falling channel of resistance from August. Prices may struggle pushing above this psychological barrier as the dominant downtrend resumes. That may push prices lower towards September lows which makes for a key psychological barrier between 1.5976 and 1.6013. Otherwise, a daily close above 1.6265 could pave the way for a climb towards October highs.

EUR/AUD Daily Chart

All Euro Charts Created in TradingView

FX Trading Resources

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See how the Euro is viewed by the trading community at the DailyFX Sentiment Page

- Just getting started? See our beginners’ guide for FX traders

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter