GBP Talking Points:

- Sterling traded lower this week across-the-board after a surprisingly strong outing in early-September.

- GBP/USD shows setup potential on both sides, but GBP/JPY may be of interest for Sterling bears while GBP/AUD retains some value for British Pound bulls.

- DailyFX Forecasts are published on a variety of markets such as Gold, the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

British Pound Breakdown Comes Back into Play

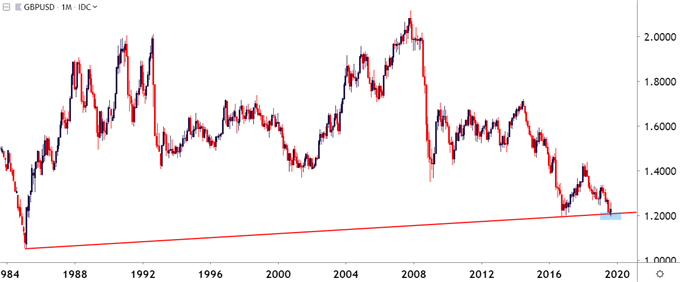

As the Q3 close nears it’s been a riveting past three months in the British Pound. Sterling came into Q3 clinging to the downtrend that had become commonplace in the British currency. And with the persistently negative headlines around the ongoing Brexit saga, the fundamental backdrop meshed with that thesis. But, in early-August, a long-term trendline came into play that helped to hold the lows in GBP/USD and, for the rest of the month, the pair exhibited back-and-forth tendencies as support began to set, and the net of last month’s price action was a doji coming in around that trendline projection.

GBP/USD Monthly Price Chart

Chart prepared by James Stanley; GBPUSD on Tradingview

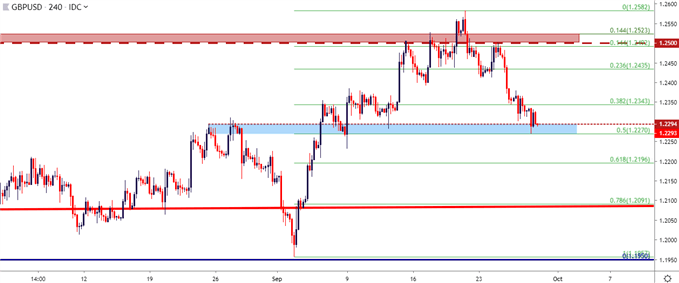

Early-September is when matters around GBP/USD became more interesting. Price action started the month with a quick dip below the 1.2000-handle after which buyers showed-up with a vengeance, evoking a topside move that could be best described as a short-squeeze after a painful five-month downtrend finally ran into support in August. Prices in GBP/USD surged by more than 500 pips as the trend-flipped and another area of resistance came into the equation. That confluent resistance around the 1.2500-handle runs very near the 1.2493 level, which is the 14.4% retracement of the September rally.

That resistance held helped to cauterize the highs and, after two weeks of failed tests, sellers were able to re-grab control going into the Q3 close, pushing prices down to the 50% marker of that same major move.

GBP/USD Four-Hour Price Chart

Chart prepared by James Stanley; GBPUSD on Tradingview

GBP/USD: Conflicting Signals, Neutral Bias

That recent hold of key support, combined with a general proclivitiy for selling to dry up below the psychological 1.2000 handle keeps open the possibility of bullish biases in the pair for Q4. But, on the diametrically opposite side of the matter the weekly chart of GBP/USD is showing an evening star formation, which will often be looked to for a continuation of a bearish reversal. But, given the fact that this bearish reversal has, so far, run into a key area of support, the matter is a bit cloudy as there’s a case to be made on either side and the driver of this will likely at least receive some bearish from USD-flows.

The technical forecast for next week will be set to neutral for GBP/USD.

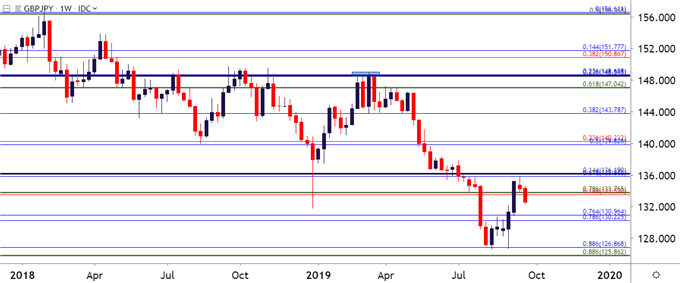

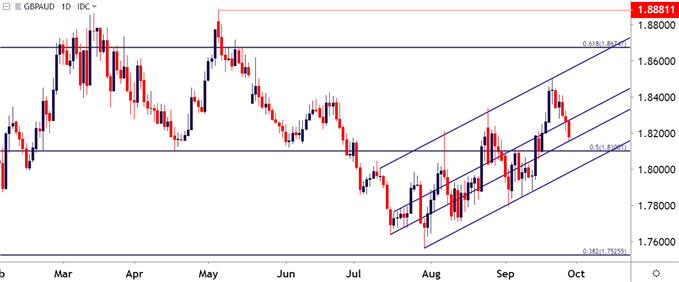

For traders that do want to focus on short-side GBP strategies, GBP/JPY may be of interest. Bullish strategies, on the other hand, may be more efficiently directed towards GBP/AUD. Charts for each are shared below.

GBP/JPY Weekly Price Chart

Chart prepared by James Stanley; GBPJPY on Tradingview

GBP/AUD Daily Price Chart

Chart prepared by James Stanley; GBPAUD on Tradingview

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources on Gold or USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX