Gold Price Technical Outlook:

- Gold continues to look strong after multi-year wedge-break

- Longs remain the focus as long as price action continues to act well

Check out the DailyFX Trading Guides page for intermediate-term forecasts, educational content aimed all experience levels, and more.

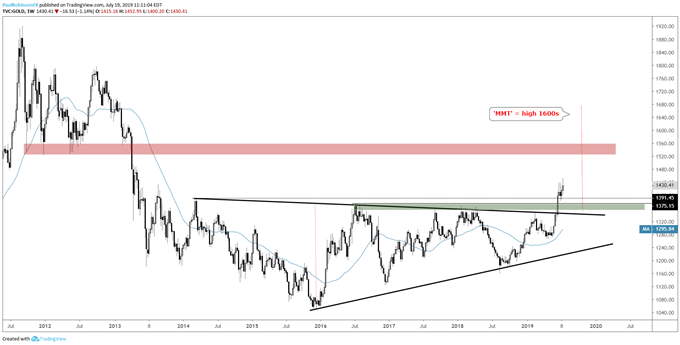

Gold continues to look strong after multi-year wedge-break

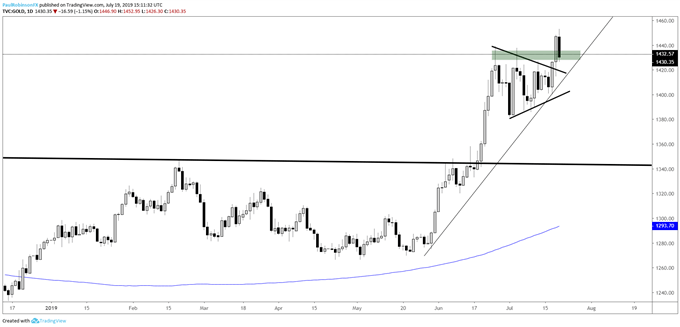

Setting the stage for a rally last month was a massive breakout from a multi-year wedge, which put shorts on hold and longs into the spotlight. Last week, we saw a small shot higher out of a short-term bullish consolidation/wedge formation, furthering along the short-term upward trading bias.

As we head into a new week, watch for gold to hold the rally from the second half of last week and stay above 1420. Price could sink a little lower than that to the developing trend-line from May, but it will be more ideal if the top of the recent consolidation pattern is held without too much of a breach.

A firm decline back inside the recent wedge will need to be only brief or else further weakness, perhaps back to the breakout levels in the 1375/60, will become a significant risk. In the event of a hold above prior resistance turned support, the ride higher might not be a smooth one but should give ‘would-be’ buyers tradeable dips and consolidations to work with.

The next area of minor resistance clocks in around a 2013 level at 1488, while the next major zone of resistance doesn’t arrive until the underside of the 2011/13 topping process, around 1520/60. Looking out longer-term, the projected target based on the multi-year wedge is closer to 1700.

Check out the IG Client Sentiment page to find out how changes in positioning in major markets could signal the next price move.

Gold Weekly Chart (Long-term wedge-break positions for higher prices)

Gold Daily Chart (stop-and-go may be the path)

Helpful Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX