GBPUSD, GBPJPY, GBPCHF Technical Outlook

- After a GBPUSD bounce last week was driven by a sell-off in the US Dollar, bears came back into Cable to push prices right back down towards prior lows.

- Next week brings a couple of key events that could keep GBPUSD on the move. Out of the UK, CPI and the Bank of England are on the calendar. But, perhaps more pertinent to GBPUSD at the moment, the FOMC hosts a rate decision on Wednesday that will keep USD-pairs in-focus.

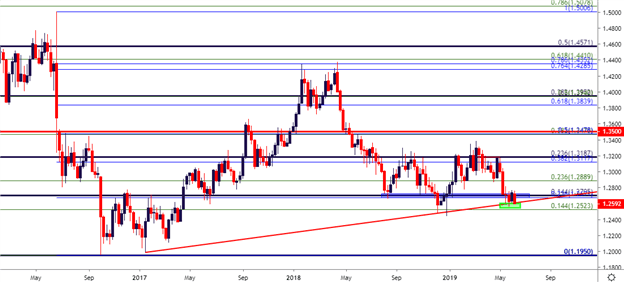

GBPUSD Heads Back Down After Last Week’s Support Bounce

Sellers came back into Cable this week, helping to not only erase the entirety of last week’s gains but to push prices back-down towards the prior May lows. To be sure, these dynamics likely have a strong relationship with recent themes in the US Dollar; as last week’s aggressive sell-off in USD was retraced this week after the currency ran into a big area of support on the chart.

In GBPUSD, that bounce from last week could be compared to other major pairs in the effort of gauging future potential. As looked at on Tuesday, the bounce in Cable was milder than what was seen elsewhere in pairs like EURUSD, alluding to the fact that GBP continues to show a lack of significant strength, even in a backdrop in which the US Dollar is getting hammered by falling rate expectations.

The primary obstacle around GBPUSD at the moment is next week’s economic calendar combined with a cloudier backdrop around the US Dollar. The USD has already clawed back a portion of last week’s losses, and next week’s FOMC rate decision will likely keep the currency in the spotlight. Given the fact that the Bank of England hosts a rate decision less than 24 hours later, and this may not be the best time to start a directional strategy on the pair. Put simply, greener pastures may be available elsewhere depending on which direction a trader wants to take the British Pound; specifically in pairs such as GBPJPY or GBPCHF which I look at below.

GBPUSD Technical Forecast: Neutral

GBPUSD Weekly Price Chart

Chart prepared by James Stanley

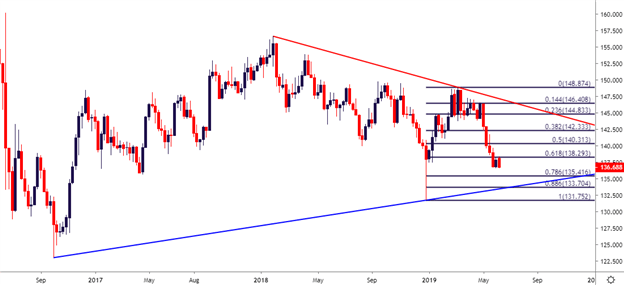

GBPJPY Builds Bearish Engulf on the Weekly

For short-side GBP strategies, GBPJPY can remain of interest. The pair similarly bounced last week from a key zone of support. But this week’s price action was a bit more telling given the build of a bearish engulfing pattern on the weekly chart. Such a formation will often be looked at for directional continuation, in this case pointing-lower; and this can keep the door open for bearish strategies in the pair. Short-side target potential could be sought around the 135.42 Fibonacci level, the 135.00 psychological level and then the 133.70 area, which is confluent between a bullish trend-line and the 88.6% retracement of the 2019 major move in the pair.

GBPJPY Technical Forecast: Bearish

GBPJPY Weekly Price Chart

Chart prepared by James Stanley

GBPAUD Builds Morning Star at Fibonacci Support

If a trader wants to buy a currency of questionable strength, it’s probably best to try to match that up with a weaker currency. In FX-land at the moment, a couple of currencies that could be picked on are the Australian and New Zealand Dollars. For next week, I’ve chosen GBPAUD as the pair retains some more attractive bullish qualities from longer-term perspectives.

This week has seen the build of a morning star formation in GBPAUD, punctuated by last week’s Doji at Fibonacci support and this week’s bullish move that retraced at least half of the previous week’s sell-off. The fact that this formation built in the spot that it did is what keeps bullish aspirations alive in the pair. This was the same support level that had helped to arrest the declines in April, and this price now marks the three-month-low in the pair. Top-side target potential could be sought out at the 1.8500 psychological level, the 1.8675 Fibonacci level, and/or the 1.8811 marker that currently constitutes the three-year-high in the pair.

GBPAUD Technical Forecast: Bullish

GBPAUD Weekly Price Chart

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources on Oil or USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX