EUR/USD Technical Highlights:

- 11500 recaptured after brief breakdown

- Price supported, but how far the euro can rise is questionable

- March trend-line, 11700s resistance targeted on strength

For the intermediate-term fundamental and technical outlook, check out the DailyFX Q4 EURO Forecast.

Heading into last week the outlook for the euro was bearish with it trading below 11500, but the notion of a breakdown extending was quickly put to rest with the key-reversal bar on Tuesday. Thursday’s solid break back on through 11500 and close near 11600 made for the second breach and reclaiming of the support shelf formed starting in May.

We’ll lean on the 11530/00 area as support as we head into a new week, giving it the benefit of the doubt to keep the bias titled neutral to higher. But how much higher? Since the end of May there have been a couple of moves which held hope for developing into a trend only to fizzle once the euro got rolling.

Keeping the current trading environment in mind we’ll continue to look for quick-hitters over trying to find the next big trend. With that said, should EUR/USD trade up to the trend-line from March and 11720/50-area we’ll once again watch for signs of stalling momentum. A break back below 11500 won’t find much trust on this end to extend with support via last week’s low and trend-lines close by.

Check out this guide with four ideas on how to Build Confidence in Trading

EUR/USD Daily Chart (Leaning on support near 11500)

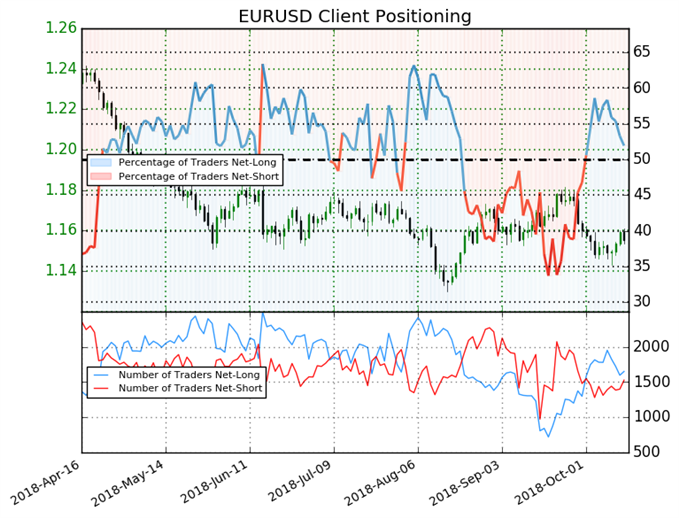

Euro Sentiment

EUR/USD IG Client Sentiment

As per IGCS, positioning shifts haven’t gleaned much insight for traders as price momentum continues to lack. This will of course change at some point, but for now we’re skeptical of indications from sentiment within the multi-month chop. For more details on the sentiment model and how it can act as a contrarian indicator, check out the IG Client Sentiment page.

Helpful Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX

Other Weekly Technical Forecast:

Australian Dollar Forecast: AUD/USD, GBP/AUD May Still Make Breakout Progress Despite U-turns

British Pound Forecast: Turning Short-Term Negative

US Dollar Forecast: Dollar's Retreat Adds Considerable Weight to a Five-Month Reversal Pattern

Equity Forecast: Technical Forecast for the Dow, S&P 500, DAX, FTSE and Nikkei